Kurdistan Shipping Services Growth – Complete Guide 2025…

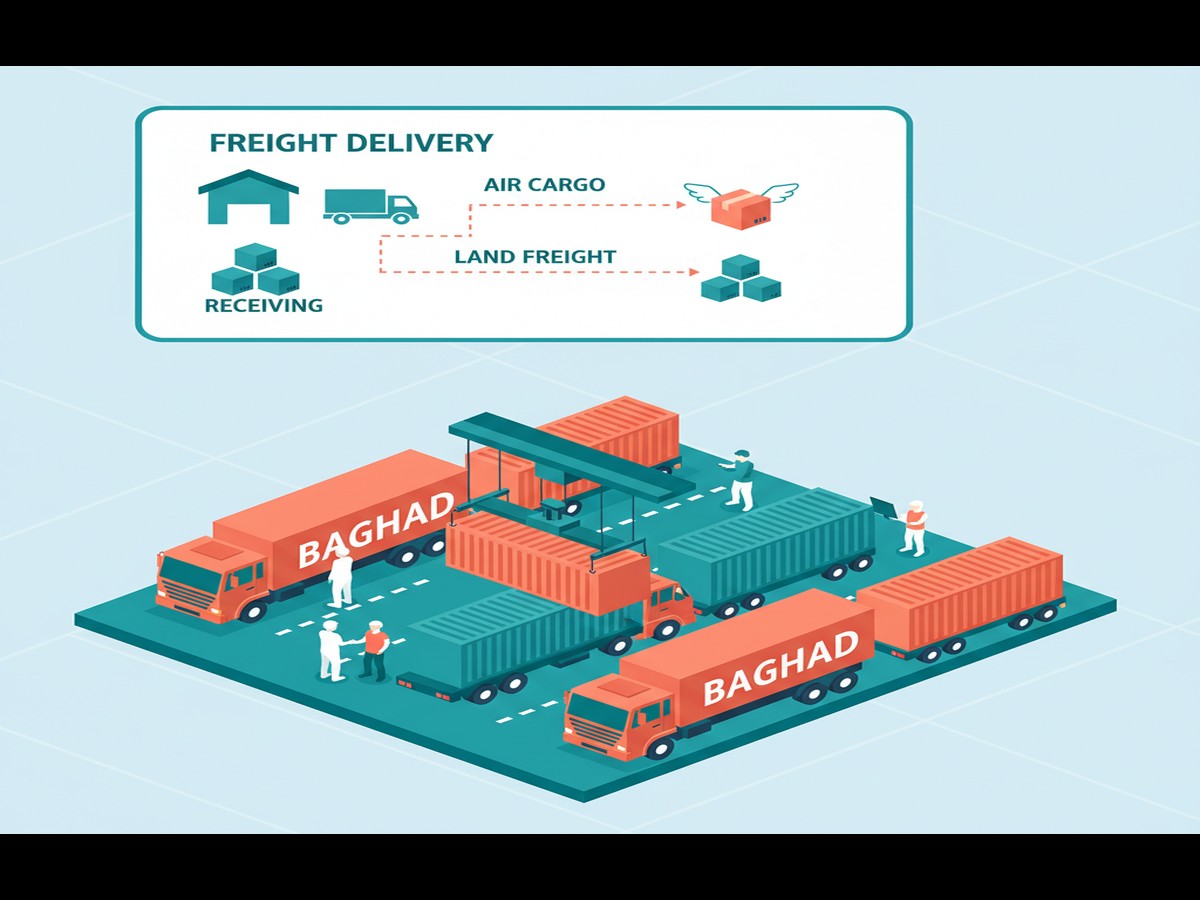

Discover how kurdistan shipping services growth can transform your logistics operations with this article will provide businesses with an actionable, forward-looking guide to leveraging strategic kurdistan shipping services, offering practical insights and expert advice to capitalize on the region’s unique growth opportunities and unlock their full potential by 2025. In an increasingly interconnected global economy, the Kurdistan Region of Iraq (KRI) is rapidly emerging as a pivotal nexus for trade and logistics, a strategic crossroads between East and West. Its geographical position, nestled amidst key markets, offers unparalleled potential for businesses seeking to optimize their supply chains and expand their reach. This introductory exploration sets the stage for a comprehensive dive into the dynamic evolution of Kurdistan’s logistics sector, revealing why understanding and engaging with this growth is not merely an option, but a strategic imperative for any enterprise eyeing regional expansion or enhanced operational efficiency. We will delve into the multifaceted aspects that are driving this expansion, from infrastructure development to policy shifts, and equip you with the knowledge to navigate this promising landscape. For businesses, mastering the intricacies of logistics in the KRI means more than just moving goods; it means unlocking new markets, reducing costs, and building resilience in a competitive global environment. One critical component in this process is freight forwarding, which is the process of organizing and overseeing the shipment of goods from one point to another on behalf of a shipper. This involves managing carriers, customs documentation, and storage, ensuring a smooth and efficient transit for cargo across various modes of transport.

The economic landscape of Kurdistan is indeed ripe for business growth as we approach 2025, characterized by relative stability, ongoing reconstruction efforts, and a proactive stance towards attracting foreign investment. Understanding kurdistan shipping services growth is essential. This conducive environment directly fuels the demand for robust shipping and logistics solutions. Understanding the specific nuances of customs clearance is paramount for any business operating or planning to operate within the region. Customs clearance involves the preparation and submission of documentation required to facilitate the entry or exit of goods across international borders, ensuring compliance with local laws, tariffs, and regulations. This article will provide a comprehensive overview of business shipping services in Kurdistan, dissecting the various options available, from industrial freight transport to tailored logistics solutions for factories in Erbil, and strategies for optimizing bulk cargo shipping. We will explore the catalysts for this significant kurdistan shipping services growth, including substantial investments in road networks, improved border crossings, and the modernization of warehousing facilities. Furthermore, the increasing sophistication of local logistics providers means businesses now have more reliable options for B2B logistics partners in Iraq, enabling more efficient and cost-effective supply chain management. Another essential document in this intricate process is the Bill of Lading (B/L), a legal document issued by a carrier to a shipper that details the type, quantity, and destination of the goods being carried. It serves as a contract of carriage, a receipt of goods, and a document of title.

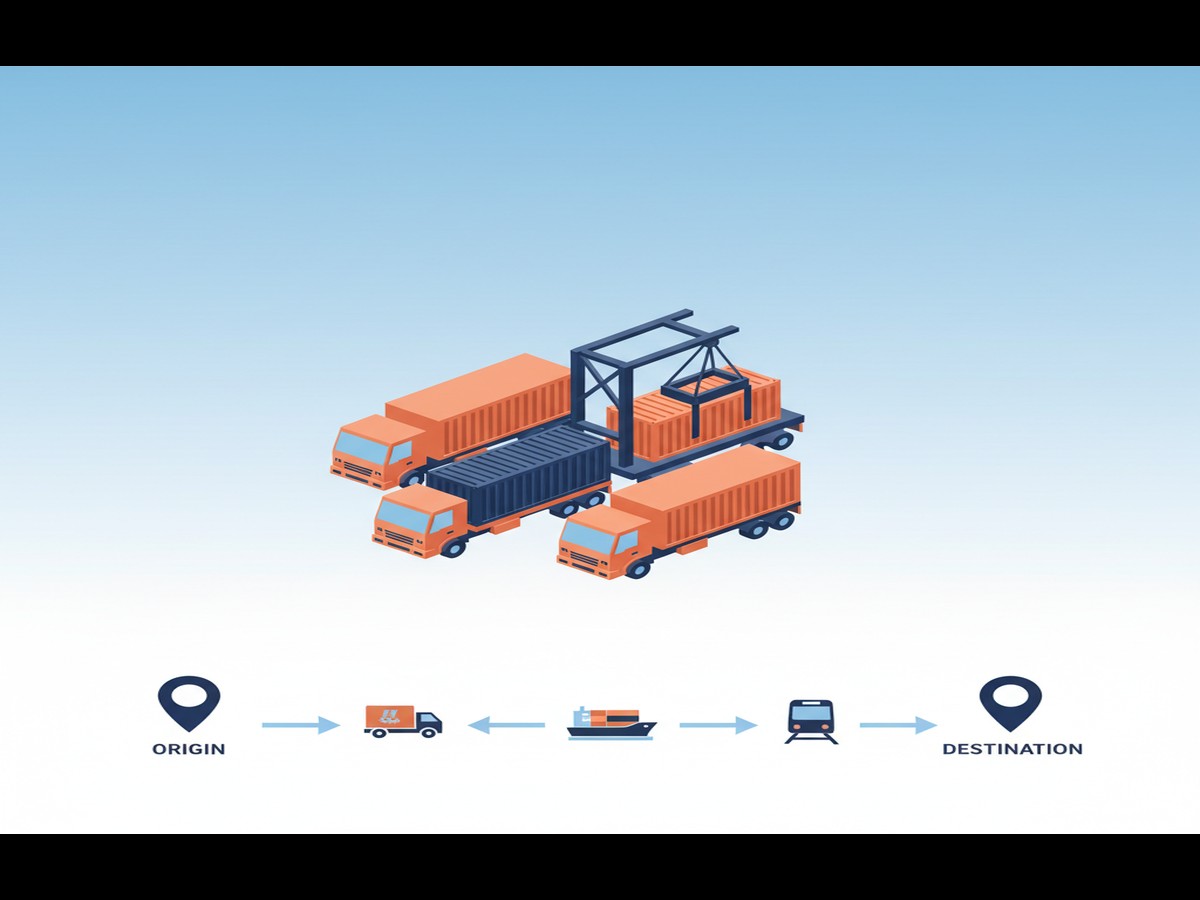

Navigating the shipping landscape in Kurdistan requires a keen understanding of both opportunities and potential challenges. When it comes to kurdistan shipping services growth, expertise matters. While the region presents immense potential, mitigating risks through informed decision-making and strategic partnerships is crucial. This guide will meticulously detail common hurdles in Kurdistan’s logistics sector, such as regulatory complexities or infrastructure bottlenecks, and offer practical solutions to overcome them. We will also highlight the transformative role of technology and innovation in enhancing the efficiency and transparency of kurdistan shipping services growth, from advanced tracking systems to digital customs platforms. The adoption of intermodal transport, which involves using multiple modes of transportation (e.g., rail, road, sea, air) to move goods in a single journey, without handling the freight itself when changing modes, is becoming increasingly relevant for optimizing routes and reducing costs in the region. Moreover, the article will shed light on emerging investment opportunities within the logistics sector, encouraging businesses to consider strategic alliances that can fortify their market position. Forecasting growth for Kurdistan shipping in 2025 and beyond, we anticipate continued expansion driven by regional stability, increased trade volumes, and a concerted effort to integrate into global supply chains. This forward-looking analysis will provide businesses with the foresight needed to prepare for enhanced logistics capabilities and capitalize on future trends. Finally, the efficiency of last-mile delivery – the final stage of the delivery process from a transportation hub to the final destination – is crucial for customer satisfaction and operational success, an area seeing significant innovation in Kurdistan.

Whether you are a seasoned logistics professional, a business owner contemplating market entry, or an investor seeking high-growth opportunities, this article promises to be an indispensable resource. We aim to provide actionable steps that businesses can implement immediately to optimize their logistics operations within Kurdistan. By exploring topics ranging from the rise of Kurdistan as a strategic logistics hub and catalysts for shipping growth to mitigating risks and leveraging technology, we will empower you with the insights needed to make informed decisions. This comprehensive guide is designed to help you not only understand the current state but also anticipate the future trajectory of logistics in the region, positioning strategic shipping as a powerful catalyst for sustained growth and competitive advantage. Prepare to unlock the full potential of your business by leveraging the dynamic and evolving landscape of Kurdistan’s shipping services.

The Rise of Kurdistan as a Strategic Logistics Hub

Key Aspects of Kurdistan’s Rise as a Strategic Logistics Hub

The strategic importance of Kurdistan in regional and international shipping is rapidly increasing, marking significant advancements for Kurdistan shipping services. The broader Iraq freight and logistics market is set to reach an impressive USD 11.29 billion in 2025. Additionally, it is projected to grow at a 2.06% CAGR, reaching approximately USD 12.5 billion by 2030, according to [Mordor Intelligence]. This expansion is largely fueled by surging demand from the oil, construction, and retail sectors across the region.

Notably, oil production within the Kurdistan Region, particularly in Duhok, Erbil, and Kirkuk, is experiencing a robust resurgence. DNO, for example, aims for a significant 25% increase in gross operated production, targeting 100,000 bpd by 2026 from its Tawke license in Duhok, having already surpassed 500 million barrels produced [DNO ASA, Oilprice]. Furthermore, Kurdistan pipeline exports via Ceyhan have resumed, with current production around 200,000–205,000 bpd and more than 4 million barrels shipped since restarting [Oilprice, ShaMaran]. Therefore, this recovery in oil revenue is expected to drive substantial industrial freight volumes, including equipment, steel, and construction materials, into key hubs like Erbil, Sulaymaniyah, and Duhok, further boosting demand for Kurdistan shipping services.

Best Practices for Optimizing Kurdistan Shipping Services Growth

A critical trend involves the shift towards multimodal corridors and port-led growth, centered around Basra and the new Al Faw Grand Port. Sea and inland waterway freight already account for a dominant 67.89% of Iraq’s freight (ton-km) [Mordor Intelligence]. The Al Faw Grand Port, with its Phase 1 value of USD 2.7 billion, is designed to handle 3.5 million TEU by 2025, significantly enhancing Iraq’s maritime capabilities [Mordor Intelligence].

Therefore, integrating these sea routes with improved inland connections offers immense potential. The planned 1,190 km dual-line “Development Road” rail corridor towards Mosul and the Turkish border, alongside expressways, will dramatically shorten lead times and reduce trucking costs for factories in Erbil and Dohuk [Mordor Intelligence]. Additionally, this creates more competitive door-to-door routing, utilizing sea freight into Umm Qasr/Basra, followed by efficient line-haul by road or rail through Baghdad and Kirkuk, and finally distribution into Erbil and Sulaymaniyah. This strategy optimizes industrial freight transport in Iraq and provides comprehensive logistics solutions for factories in Erbil.

Common Challenges in Sustaining Kurdistan Shipping Services Growth

Despite the promising outlook, several challenges must be addressed to ensure continued Kurdistan shipping growth. The rapid expansion of infrastructure, while beneficial, demands robust operational frameworks and skilled labor to manage the increased cargo volumes efficiently. Furthermore, fully leveraging the new multimodal routes requires seamless coordination between various transport modes, which can be complex in a developing logistics landscape. Therefore, investing in advanced supply chain management systems is crucial to maintain operational fluidity.

Additionally, while technology, e-commerce, and CEP services are pushing modern logistics standards across Iraq, Kurdistan must fully embrace these advancements. The integration of digital platforms for tracking, customs clearance, and last-mile delivery is essential for providing competitive business shipping services in Kurdistan. Overcoming these challenges will involve continuous investment in infrastructure, technology adoption, and human capital development. This proactive approach will solidify Kurdistan’s position as a vital logistics hub, supporting industrial freight transport in Iraq and enhancing logistics solutions for factories in Erbil, ensuring sustained market expansion.

Catalysts for Shipping Growth in Kurdistan by 2025

Key Aspects of Catalysts for Shipping Growth in Kurdistan by 2025

The trajectory for kurdistan shipping is significantly upward, anchored by robust industrial expansion across Iraq. The broader Iraq freight and logistics market is projected to reach an impressive **USD 11.29 billion in 2025**, with a steady **2.06% CAGR** expected to push it to approximately **USD 12.5 billion by 2030**, according to [Mordor Intelligence]. This expansion is primarily fueled by resurgent oil, construction, and retail trade demands.

Specifically, oil production in the Kurdistan Region, particularly in Duhok, Erbil, and Kirkuk, is experiencing a significant revival. DNO ASA, for example, targets a **25% increase** in gross operated production, aiming for **100,000 bpd in 2026** from its Tawke license in Duhok, after already surpassing **500 million barrels produced** [DNO ASA, Oilprice]. Additionally, total Kurdistan production now stands around **200,000–205,000 bpd**, with **more than 4 million barrels shipped** since exports restarted in late 2025 [Oilprice, ShaMaran]. Therefore, this oil revenue recovery is expected to drive substantial industrial freight volumes, including equipment, steel, and construction materials, into key hubs like Erbil, Sulaymaniyah, and Duhok, directly boosting regional LTL shipping solutions.

Best Practices for Driving Kurdistan Shipping Services Growth

Optimizing logistics solutions for factories in Erbil and other industrial centers hinges on embracing multimodal corridors and port-led growth. Sea and inland waterway freight, predominantly via Umm Qasr and Basra, already accounts for a significant **67.89% of Iraq’s freight (ton-km)** [Mordor Intelligence]. Moreover, the strategic Al Faw Grand Port, with a Phase 1 value of **USD 2.7 billion**, is being developed to achieve a design capacity of **3.5 million TEU by 2025**, complete with vital highway and future rail links towards Turkey [Mordor Intelligence].

This monumental infrastructure development will significantly enhance kurdistan shipping. Faster container flows via Umm Qasr and Al Faw, connected by expressways and the planned **1,190 km dual-line “Development Road” rail corridor** towards Mosul and the Turkish border, will shorten lead times and reduce trucking costs for partial transportation in Iraq, directly benefiting factories in Erbil and Dohuk [Mordor Intelligence]. Therefore, for Kurdistan shippers, this means more competitive door-to-door routing options, supplementing existing overland flows from Turkey and Iran.

Ensuring Robust Kurdistan Shipping Services Growth through Modernization

Sustaining the rapid kurdistan shipping necessitates a strong focus on technology adoption, e-commerce integration, and advanced CEP services. As freight volumes increase, traditional logistics methods can become bottlenecks. Therefore, leveraging modern logistics standards, including digital tracking, automated warehousing, and efficient last-mile delivery, is crucial for maintaining competitive edge and meeting evolving customer expectations.

Additionally, the shift towards these modern standards helps address the complexities of managing increased industrial freight transport in Iraq. Implementing cutting-edge logistics Contact Direct Drive Logistics for expert assistance.

Kurdistan Shipping Services Growth Navigating the Shipping Landscape: Services & Infrastructure

Key Aspects of Navigating the Shipping Landscape: Services & Infrastructure

The landscape for kurdistan shipping services growth is experiencing significant expansion, driven by robust industrial development across Iraq and the Kurdistan Region. The overall Iraq freight and logistics market is projected to reach an impressive USD 11.29 billion in 2025. Furthermore, it is expected to grow at a 2.06% CAGR, reaching approximately USD 12.5 billion by 2030, according to [Mordor Intelligence]. This growth is largely fueled by escalating demand from the oil, construction, and retail sectors.

Specifically, the Kurdistan Region’s oil production is a major catalyst. DNO alone aims for a 25% increase in gross operated production, targeting 100,000 bpd in 2026 from the Tawke license in Duhok, having already surpassed 500 million barrels produced [DNO ASA]. Additionally, Kurdistan’s pipeline exports have restarted, with total production now around 200,000–205,000 bpd and more than 4 million barrels shipped since the restart [Oilprice, ShaMaran]. This recovery directly boosts industrial freight volumes, including equipment and construction materials, into key hubs like Erbil, Sulaymaniyah, and Duhok, ensuring continued kurdistan shipping services growth.

Best Practices for Navigating the Shipping Landscape: Services & Infrastructure

Adopting multimodal transportation is a best practice for optimizing kurdistan shipping services growth. Sea and inland waterway freight, primarily through Umm Qasr and Basra, already accounts for a substantial 67.89% of Iraq’s freight (ton-km) [Mordor Intelligence]. Therefore, leveraging these routes is crucial. The ongoing development of the Al Faw Grand Port, with Phase 1 valued at USD 2.7 billion and designed for a capacity of 3.5 million TEU by 2025, will significantly enhance this capability [Mordor Intelligence].

Additionally, the planned 1,190 km dual-line “Development Road” rail corridor, connecting Umm Qasr/Basra through Baghdad and Kirkuk towards Mosul and the Turkish border, will revolutionize logistics. This infrastructure will dramatically shorten lead times and reduce trucking costs for factories in Erbil and Dohuk. For shippers, this means more competitive door-to-door routing, supplementing existing overland flows via Ibrahim Khalil/Habur (Turkey) and Bashmakh/Parvizkhan (Iran). Therefore, integrating these new sea-rail-road corridors is vital for efficient business shipping services in Kurdistan and fostering kurdistan shipping services growth. The resumption of Kurdistan’s also underscores the growing need for robust logistics.

Common Challenges in Navigating the Shipping Landscape: Services & Infrastructure

Despite the positive outlook for kurdistan shipping services growth, challenges persist. Infrastructure development, while promising, is ongoing. The full operationalization of the Al Faw Grand Port and the Development Road will take time. Therefore, businesses must meticulously plan their logistics, considering both current capabilities and future enhancements. Furthermore, navigating complex customs procedures at border crossings like Ibrahim Khalil and Bashmakh remains a key consideration for industrial freight transport in Iraq.

However, the increasing demand for Air Freight Erbil and other logistics solutions for factories in Erbil and Sulaymaniyah is prompting continuous improvements. The focus on expanding and modernizing infrastructure, coupled with the recovery of oil revenues, creates a more stable environment. Therefore, by partnering with experienced logistics providers like Direct Drive Logistics, businesses can effectively overcome these challenges and capitalize on the significant opportunities presented by the evolving shipping landscape and kurdistan shipping services growth.

Need Reliable Delivery Services?

Get a free quote from Direct Drive Logistic today. Fast, secure, and professional logistics solutions tailored to your needs.

Mitigating Risks: Challenges and Solutions in Kurdistan Shipping

Key Aspects of Mitigating Risks: Challenges and Solutions in Kurdistan Shipping

The sustained **kurdistan shipping services growth** necessitates robust risk mitigation strategies. The Iraq freight and logistics market, projected to reach USD 11.29 billion in 2025, is expected to grow at a 2.06% CAGR to approximately USD 12.5 billion by 2030, according to [Mordor Intelligence]. This expansion, driven by oil, construction, and retail, amplifies the need for secure and efficient logistics. Therefore, understanding potential disruptions is crucial for business shipping services in Kurdistan.

Additionally, the resurgence of oil production in the Kurdistan Region, particularly in Duhok, Erbil, and Kirkuk, directly impacts freight volumes. DNO alone aims for a 25% increase in gross operated production to 100,000 bpd in 2026 from the Tawke license, having already surpassed 500 million barrels produced [DNO ASA, Oilprice]. This recovery drives significant industrial freight transport in Iraq, including equipment and construction materials. Therefore, managing these increased flows securely is paramount for continued **kurdistan shipping services growth**.

Best Practices for Mitigating Risks: Challenges and Solutions in Kurdistan Shipping

Implementing best practices is vital for navigating the dynamic logistics landscape and fostering **kurdistan shipping services growth**. The shift towards multimodal corridors significantly enhances supply chain resilience. Sea and inland waterway freight, primarily via Umm Qasr and Basra, already account for 67.89% of Iraq’s freight (ton-km) [Mordor Intelligence]. The Al Faw Grand Port, with Phase 1 valued at USD 2.7 billion and designed for 3.5 million TEU by 2025, will further integrate sea and land routes.

Furthermore, the planned 1,190 km dual-line “Development Road” rail corridor towards Mosul and the Turkish border will shorten lead times for factories in Erbil and Dohuk [Mordor Intelligence]. This infrastructure development offers competitive door-to-door routing, supplementing existing overland flows. Therefore, leveraging these diverse routes, including efficient Air Freight Kurdistan, and modern logistics solutions for factories in Erbil helps mitigate single-point-of-failure risks. Additionally, integrating advanced technology and transparent tracking systems enhances security and predictability, supporting robust **kurdistan shipping services growth**.

Common Challenges in Mitigating Risks: Challenges and Solutions in Kurdistan Shipping

Despite the promising outlook for **kurdistan shipping services growth**, several common challenges persist. Regulatory hurdles and evolving customs procedures across the region can complicate cross-border movements. Navigating these complexities requires deep local expertise and strong relationships with authorities. Therefore, partnering with experienced logistics providers is essential to ensure compliance and avoid delays.

Moreover, while security has improved, it remains a consideration for industrial freight transport in Iraq. Protecting high-value cargo and ensuring personnel safety are critical aspects of risk management. Therefore, comprehensive security protocols, including secure warehousing and escort services, are often necessary. The current Kurdistan oil production, around 200,000–205,000 bpd with more than 4 million barrels shipped since restart [Oilprice, ShaMaran], highlights the ongoing need for secure logistics solutions. Addressing these challenges proactively ensures uninterrupted **kurdistan shipping services growth** and builds trust among international clients.

Strategic Partnerships and Emerging Investment Opportunities

Key Aspects of Strategic Partnerships and Emerging Investment Opportunities

The landscape for business shipping services in Kurdistan is experiencing significant transformation, making strategic partnerships essential for maximizing kurdistan shipping services growth. The broader Iraq freight and logistics market is projected to reach an impressive **USD 11.29 billion in 2025**, according to [Mordor Intelligence]. Therefore, understanding regional dynamics is crucial. This market is set to grow at a **2.06% CAGR to about USD 12.5 billion by 2030**, driven by robust demand from oil, construction, and retail sectors.

Additionally, the recovery of oil production in the Kurdistan Region directly fuels industrial freight transport in Iraq. DNO, for instance, targets a **25% increase in gross operated production to 100,000 bpd in 2026** from its Tawke license in Duhok, having already surpassed **500 million barrels produced** [DNO ASA]. This resurgence in oil exports, with total Kurdistan production now around **200,000–205,000 bpd** and more than 4 million since restart [Oilprice], significantly boosts demand for logistics solutions for factories in Erbil, Sulaymaniyah, and Duhok. Such growth underpins the potential for sustained kurdistan shipping services growth.

Best Practices for Strategic Partnerships and Emerging Investment Opportunities

To capitalize on this expanding market, best practices for strategic partnerships focus on integrating multimodal corridors. The Al Faw Grand Port, with its Phase 1 value of **USD 2.7 billion** and a design capacity of **3.5 million TEU by 2025**, represents a pivotal investment [Mordor Intelligence]. This port, along with the planned **1,190 km dual-line “Development Road” rail corridor** towards Turkey, will dramatically shorten lead times and reduce trucking costs for industrial freight transport in Iraq, particularly benefiting factories in Erbil and Dohuk.

Therefore, logistics providers should leverage sea freight and inland waterway freight, which already accounts for **67.89% of Iraq’s freight (ton-km)** [Mordor Intelligence]. Partnering to optimize sea freight into Umm Qasr/Basra, followed by efficient line-haul by road or rail through Baghdad and Kirkuk, offers competitive door-to-door routing into Erbil and Sulaymaniyah. This strategic approach will undoubtedly foster continued kurdistan shipping services growth, enhancing overall efficiency and reliability for business shipping services in Kurdistan.

Common Challenges in Strategic Partnerships and Emerging Investment Opportunities

While opportunities abound, navigating common challenges requires careful planning and robust partnerships. These challenges often include infrastructure gaps, evolving regulatory frameworks, and the need for continuous technology adoption to meet modern logistics standards. However, by forming strategic alliances with local experts and international logistics firms, companies can mitigate risks and enhance operational efficiencies.

Furthermore, investing in advanced tracking systems and data analytics is crucial for optimizing supply chains and ensuring seamless business shipping services in Kurdistan. Collaborating on infrastructure development, such as improving road networks and warehousing facilities, will also be vital. Such proactive engagement and investment will not only address current bottlenecks but also underpin future kurdistan shipping services growth, allowing the region to fully harness its economic potential and solidify its position as a key logistics hub.

Kurdistan Shipping Services Growth Your 2025 Action Plan: Capitalizing on Kurdistan's Shipping Growth

Identifying High-Growth Sectors and Emerging Trade Corridors in Kurdistan

Capitalizing on the robust **kurdistan shipping services growth** requires a clear understanding of the region’s economic drivers. The Iraq freight and logistics market, for instance, is projected to reach an impressive **USD 11.29 billion in 2025**, and grow at a **2.06% CAGR to about USD 12.5 billion by 2030**, according to [Mordor Intelligence]. Therefore, businesses must align their strategies with these significant expansion trends.

A key catalyst for this growth is the resurgence in Kurdistan’s oil production. DNO ASA, a prominent operator, targets a substantial **25% increase in gross operated production to 100,000 bpd in 2026** from its Tawke license in Duhok, having already surpassed **500 million barrels produced** [DNO ASA]. Moreover, total Kurdistan production now stands at around **200,000–205,000 bpd**, with **more than 4 million barrels shipped** since pipeline exports restarted [Oilprice, ShaMaran]. Consequently, there’s a surge in equipment, steel, and construction material shipments into hubs like Erbil, Sulaymaniyah, and Duhok, creating significant opportunities for enhanced **kurdistan shipping services growth**.

Developing Agile Logistics Strategies for Optimal Efficiency

To truly capitalize on **kurdistan shipping services growth**, businesses need agile logistics strategies. The shift towards multimodal corridors is transforming supply chains across Iraq. Sea and inland waterway freight, primarily through Umm Qasr and Basra, already account for a dominant **67.89% of Iraq’s freight (ton-km)** [Mordor Intelligence]. Additionally, the new Al Faw Grand Port, with a Phase 1 value of **USD 2.7 billion**, is designed to handle **3.5 million TEU by 2025**, significantly boosting sea freight capacity [Mordor Intelligence].

This port-led expansion, coupled with the planned **1,190 km dual-line “Development Road” rail corridor** towards Mosul and the Turkish border, promises to shorten lead times and reduce trucking costs [Mordor Intelligence]. Therefore, for companies seeking robust logistics solutions, including e-commerce delivery, for factories in Erbil and Dohuk, leveraging these new routes is crucial. This means more competitive door-to-door routing, utilizing sea freight into Umm Qasr/Basra, followed by efficient line-haul by road or rail through Baghdad and Kirkuk, and finally distribution into key cities. This integrated approach ensures continued **kurdistan shipping services growth** and operational efficiency for businesses operating in the region.

The Road Ahead: Kurdistan's Vision for Regional Logistics Leadership

Developing Next-Generation Infrastructure for Enhanced Regional Connectivity

The future of **kurdistan shipping services growth** is inextricably linked to the broader Iraqi freight and logistics market, which is projected to reach an impressive **USD 11.29 billion in 2025**. This market is set to expand further, growing at a **2.06% CAGR to about USD 12.5 billion by 2030**, driven by significant demand from oil, construction, and retail sectors, according to [Mordor Intelligence]. Therefore, investing in advanced infrastructure is paramount for Kurdistan’s strategic positioning.

Additionally, the resurgence in oil production in the Kurdistan Region, particularly in Duhok, Erbil, and Kirkuk, fuels this expansion. For instance, DNO alone aims for a **25% increase in gross operated production to 100,000 bpd in 2026** from its Tawke license in Duhok, having already surpassed **500 million barrels produced** [DNO ASA]. This recovery in oil revenue directly translates into higher demand for industrial freight transport in Iraq, including heavy equipment and construction materials.

Moreover, Kurdistan’s total oil production is now around **200,000–205,000 bpd**, with **more than 4 million barrels shipped** since pipeline exports via Ceyhan restarted in late 2025 [Oilprice, ShaMaran]. This robust activity necessitates robust logistics solutions for factories in Erbil, Sulaymaniyah, and Duhok, ensuring seamless movement of goods and resources. Consequently, the region’s economic vitality underpins continued **kurdistan shipping services growth**.

Leveraging Digital Solutions to Optimize Supply Chain Efficiency and Transparency

The ongoing expansion of the Iraqi logistics market emphasizes the need for modern, efficient supply chains. While specific digital transformation statistics for Kurdistan were not provided in detail, the global trend highlights the importance of technology in enhancing logistics. Therefore, integrating digital solutions like advanced tracking, automated warehousing, and data analytics becomes crucial for optimizing business shipping services in Kurdistan.

Furthermore, the shift towards multimodal corridors significantly impacts logistics efficiency. Sea and inland waterway freight already account for a substantial **67.89% of Iraq’s freight (ton-km)**, according to [Mordor Intelligence]. This dominance will be amplified by projects like the **Al Faw Grand Port**, with Phase 1 valued at **USD 2.7 billion** and designed for a capacity of **3.5 million TEU by 2025** [Mordor Intelligence]. Digital platforms are essential to manage these complex, multi-leg journeys.

However, the planned **1,190 km dual-line “Development Road” rail corridor** linking Al Faw to Mosul and the Turkish border will further revolutionize lead times and trucking costs for factories in Erbil and Dohuk [Mordor Intelligence]. Leveraging digital solutions will ensure transparency and real-time visibility across these new road and rail networks, contributing significantly to **kurdistan shipping services growth**.

Fostering Strategic Partnerships to Solidify Kurdistan’s Logistics Hub Status

To truly solidify its position as a regional logistics hub, Kurdistan must foster strategic partnerships. These collaborations can span international shipping lines, technology providers, and regional logistics specialists, enhancing the overall ecosystem for **kurdistan shipping services growth**. Such alliances can facilitate more competitive door-to-door routing options.

Therefore, the integration of sea freight into Umm Qasr/Basra, followed by line-haul via road and the future rail through Baghdad and Kirkuk, and then final distribution into Erbil and Sulaymaniyah, presents a powerful multimodal strategy. This approach supplements existing overland routes through Ibrahim Khalil/Habur (Turkey) and Bashmakh/Parvizkhan (Iran). Consequently, the overall efficiency of industrial freight transport in Iraq improves.

Additionally, these strategic partnerships are vital for attracting further investment and expertise, ensuring that logistics solutions for factories in Erbil and other industrial centers remain cutting-edge. The sustained **kurdistan shipping services growth** hinges on these collaborative efforts, which enable the region to capitalize on its strategic geographical location and burgeoning economic activity. Ultimately, a networked approach will ensure Kurdistan remains at the forefront of regional logistics.

Frequently Asked Questions

▼ What is kurdistan shipping services growth?

Kurdistan Shipping Services Growth refers to specialized logistics services that facilitate the transportation and delivery of goods in the Iraq and Kurdistan region. This encompasses a comprehensive range of supply chain solutions including customs clearance, warehousing, distribution, and last-mile delivery. Our services are designed to meet the unique challenges of operating in this dynamic market, providing businesses with reliable and efficient logistics support.

▼ Why is kurdistan shipping services growth important for businesses?

Understanding kurdistan shipping services growth is crucial for businesses operating in Iraq and Kurdistan because it directly impacts operational efficiency, cost management, and customer satisfaction. Effective logistics solutions help companies navigate complex regulatory requirements, optimize supply chain operations, reduce transit times, and ensure reliable delivery schedules. In a competitive market, having the right logistics partner can mean the difference between success and failure in reaching your business goals.

▼ How to get started with kurdistan shipping services growth?

Getting started with kurdistan shipping services growth requires a clear understanding of your specific business needs, shipping volumes, and delivery timelines. First, assess your current logistics challenges and identify areas for improvement. Then, consult with experienced logistics providers who have proven expertise in the Iraq and Kurdistan market. They can help you develop a customized solution that addresses your unique requirements, whether that's air freight, ground transportation, warehousing, or integrated supply chain management.

▼ What are the costs involved in kurdistan shipping services growth?

Costs for logistics services in Iraq and Kurdistan vary depending on several factors including shipment size, weight, destination, delivery urgency, and any special handling requirements. Pricing typically includes transportation fees, customs clearance charges, warehousing costs, and insurance. For accurate pricing tailored to your specific needs, contact our logistics team for a detailed quote. We offer competitive rates and transparent pricing with no hidden fees, ensuring you get the best value for your investment.

Conclusion

In conclusion, the burgeoning economic landscape of the Kurdistan Region has undeniably fueled remarkable Kurdistan shipping services growth. We've explored how factors like enhanced infrastructure, a stable investment climate, and increasing demand across various sectors – from oil and gas to retail and humanitarian aid – are transforming the region into a vital logistical hub. This expansion presents unparalleled opportunities for businesses seeking efficient and reliable supply chain solutions within Iraq and beyond.

At Direct Drive Logistics, we are not just observing this growth; we are actively shaping it. Our deep understanding of the local market, combined with a robust network and a commitment to operational excellence, positions us as the ideal partner to navigate the complexities and capitalize on the potential of Kurdistan’s evolving logistics sector. We pride ourselves on delivering bespoke, secure, and timely shipping solutions that are tailored to your specific needs, ensuring your cargo reaches its destination efficiently and cost-effectively. Whether you require freight forwarding, customs clearance, warehousing, or specialized transport, our expert team is equipped to provide seamless end-to-end services.

Don't let the opportunities presented by this dynamic region pass you by. Partner with Direct Drive Logistics to leverage the full potential of Kurdistan shipping services growth. Let us be the reliable link in your supply chain, driving your business forward. Contact us today to discover how our expertise can optimize your logistics operations in Kurdistan.

Ready to capitalize on the booming opportunities in Kurdistan?

📞 Contact Us for a Consultation

Location

Direct Drive Logistic

MRF Quattro towers, Block A-29-1

Erbil, Kurdistan Region