Corona Virus On International Transportation Fares -…

Discover how corona virus on international transportation fares can transform your logistics operations with this article uniquely explores the multifaceted effects of the coronavirus on international transportation fares, with a specific focus on the iraqi logistics landscape. The COVID-19 pandemic was more than a global health crisis; it was a black swan event that sent shockwaves through the intricate web of global supply chains, fundamentally rewriting the rules of logistics and transportation. For decades, businesses operated on a model of predictable shipping schedules and relatively stable costs. The pandemic shattered this equilibrium, introducing unprecedented volatility, capacity constraints, and a level of complexity that continues to challenge even the most seasoned logistics professionals. From grounded passenger flights that decimated air cargo capacity to port congestion that left container ships idling for weeks, every facet of international movement was disrupted. This disruption translated directly into a dramatic and often unpredictable surge in transportation costs, forcing businesses worldwide to re-evaluate their supply chain strategies, sourcing decisions, and pricing models. Understanding the nuances of these changes is no longer just an operational concern; it is a critical strategic imperative for survival and growth in the post-pandemic era.

This comprehensive guide explores the impact of the corona virus on international transportation fares through multiple, interconnected perspectives, providing a roadmap to navigate this new and challenging environment. Understanding corona virus on international transportation fares is essential. We will begin by establishing a baseline with a global overview of transportation fares before the pandemic, setting the stage to fully appreciate the scale of the disruption. From there, we will dissect the immediate effects of COVID-19 on international shipping costs, examining the specific factors that drove prices to historic highs. A core component of our analysis is a detailed case study focusing on Iraq’s import and export trends during the pandemic, offering a granular look at how a specific, dynamic market responded to global pressures. We will further explore the intricacies of customs clearance in Iraq, a critical bottleneck where pandemic-related changes had a profound impact. This is where understanding terms like freight surcharge becomes essential; a freight surcharge is an additional fee levied by a carrier to cover unforeseen costs like pandemic-induced labor shortages, port congestion, or sudden fuel price hikes, which became a significant and volatile part of total shipping expenses. Our regional deep-dive will analyze the unique logistics landscapes of shipping to Kurdistan, the adaptation of new norms in Erbil, and how COVID-19 reshaped local transportation dynamics in Baghdad. We will then look toward the horizon with future projections for international fares, provide actionable strategies for businesses to mitigate these increased costs, and conclude with key lessons learned and a forward-looking outlook. Whether you are a global logistics manager or a local business owner, you will gain actionable insights to enhance your operational resilience and strategic planning.

What sets this analysis apart is its commitment to moving beyond surface-level observations. When it comes to corona virus on international transportation fares, expertise matters. Unlike many discussions on the topic, we provide an in-depth comparative analysis of transportation fares, charting their evolution before, during, and in the aftermath of the pandemic’s peak. This timeline-based approach reveals critical trends and patterns that are essential for future forecasting. We will also present a detailed breakdown of fare changes by key global trade lanes, highlighting the regional disparities that saw some routes experience exponential cost increases while others saw more moderate fluctuations. A crucial, yet often overlooked, aspect we will investigate is the shift in consumer behavior—from the e-commerce boom to changes in travel patterns—and its direct, cascading impact on fare pricing and capacity allocation. Navigating this new reality requires a firm grasp of technical processes, such as customs clearance, which is the formal procedure of preparing and submitting all necessary documentation to facilitate the legal import or export of goods. The pandemic severely complicated this process, introducing new health protocols and paperwork, leading to significant delays and administrative costs that directly inflated final transportation fares. These delays often resulted in punitive fees, making a clear understanding of concepts like demurrage and detention—penalties charged by shipping lines for the late return of containers—absolutely critical for cost management.

Our specific focus on Iraq serves as a powerful microcosm of the global challenges, offering tangible lessons for businesses operating in emerging or complex markets. Iraq’s unique geopolitical landscape, coupled with its reliance on imports, created a perfect storm when global supply chains seized up. By examining the specific adaptations within key hubs like Erbil and Baghdad, we can extract valuable strategies for building agility and resilience. This micro-level analysis illuminates how global shocks are transmitted to local economies and how businesses on the ground can pivot to survive and thrive. For any Iraqi importer or exporter, calculating the true cost of goods became exponentially more difficult, demanding a rigorous understanding of the landed cost, which represents the total price of a product upon its arrival, encompassing the original purchase price, all transportation fees, customs duties, taxes, insurance, and any pandemic-related surcharges. Accurately forecasting this landed cost became the difference between profit and loss for countless enterprises. The insights gleaned from the Iraqi experience are not just regional; they provide a universal blueprint for navigating supply chain disruptions in any volatile market. This article is designed to be your definitive guide, equipping you with the knowledge and strategic foresight needed to master the complexities of post-pandemic logistics. Now, let us begin by examining the pre-pandemic fare landscape to fully grasp the magnitude of the transformation that has reshaped our world.

Introduction: The Pandemic's Unprecedented Shock to Global Travel

**Section Title:** Introduction: The Pandemic’s Unprecedented Shock to Global Travel

**Section Content:**

Dramatic Decline in International Travel Volumes and Passenger Mobility Patterns

The initial shock of the corona virus on international transportation fares was profound, leading to unprecedented disruptions across global supply chains. Factory closures, widespread lockdowns, and a sudden surge in e-commerce demand quickly led to severe container shortages and significant port backlogs worldwide. Consequently, global shipping costs began to spike, nearing pandemic peaks by mid-2024 before a partial easing [2][9]. This situation significantly impacted Iraq’s import/export volumes, causing substantial delays at critical border crossings such as Ibrahim Khalil (Turkey) and Shalamcheh (Iran). These delays exacerbated costs for shipping to Kurdistan, particularly for shipments destined for Erbil, while also increasing clearance times in Baghdad amid stringent health restrictions [1][2]. Therefore, businesses had to swiftly adapt to new operational realities. For more insights into the challenges, consider this resource on the shipping industry impact.

Economic Disruption and Immediate Impact on Global Transportation Infrastructure

The lingering effects of the corona virus on international transportation fares continue to manifest as persistent freight rate volatility. Compared to pre-COVID levels, container freight rates remain elevated and unpredictable. For example, the Shanghai Containerized Freight Index averaged 2,496 points in 2024, marking a substantial increase of 149% from 2023 [4]. This volatility is primarily driven by ongoing supply-demand imbalances, a direct legacy of pandemic disruptions like container shortages and port congestion. In Iraq, this has directly affected imports arriving via Umm Qasr and Khor Al-Zubair ports, where higher international shipping costs, especially from Asia routes, have increased logistics expenses for businesses in Erbil and Baghdad that rely heavily on Chinese goods [3][1]. Therefore, understanding these dynamics is crucial for effective Iraq import export operations. Asia-US West Coast rates were projected at $2,119 per FEU in 2025 [3]. Additionally, managing elevated shipping costs has become a key concern for regional logistics providers.

Transformation of Travel Policies and Emerging Safety Protocols Worldwide

The long-term impact of the corona virus on international transportation fares is further complicated by geopolitical pressures and necessary vessel rerouting. Due to disruptions in the Red Sea and Suez Canal, vessel rerouting increased ton-miles by 6% in 2024, which sustained high freight rates despite a modest global trade growth of 2.2% [4]. Maritime trade is now projected to slow significantly to 0.5% in 2025 [4]. This situation directly affects Middle East routes, including those passing through the Strait of Hormuz, which handles 11% of global trade. Consequently, Iraq’s oil and goods transport from Basra faces increased fares for imports destined for Najaf and Sulaymaniyah compared to pre-COVID baselines [4][3]. Moreover, COVID-19 legacy effects include ongoing port congestion and enhanced safety measures at key Iraqi hubs like Umm Qasr. For instance, 2025 Asia-N. Europe rates are projected at $3,327 per FEU, which is down 3% but still significantly above pre-pandemic levels [3][5][6]. Therefore, adapting to these new protocols, including digital tracking to cut delays at Fishkhabour crossings, is vital for efficient customs clearance Iraq. Further insights on this trend are available in the maritime trade outlook.

Corona Virus On International Transportation Fares Pre-Pandemic Fare Landscape: Establishing a Baseline for Comparison

Historical Pricing Trends in International Transportation Across Major Global Routes

The impact of the corona virus on international transportation fares has been significant, with container freight rates remaining elevated. In 2024, the Shanghai Containerized Freight Index averaged 2,496 points, representing a 149% increase from 2023. This volatility has directly affected the logistics landscape in Iraq, where international shipping costs surged due to higher freight rates, particularly through Umm Qasr and Khor Al-Zubair ports. For instance, Asia-US West Coast shipping rates are projected to reach $2,119 per FEU in 2025, which adds substantial pressure on importers in Erbil and Baghdad.

Additionally, the corona virus on international transportation fares led to a marked increase in logistics expenses. The shift in demand due to factory closures and e-commerce surges resulted in container shortages and port congestion, impacting delivery timelines. According to the UNCTAD report, maritime trade growth is expected to stall at 0.5% in 2025 amid these persistent challenges. The cumulative effect of these disruptions has necessitated that businesses in Iraq adapt their logistics strategies significantly.

Seasonal Variations and Factors Influencing Pre-COVID Transportation Fare Structures

Before the pandemic, seasonal variations played a crucial role in determining transportation fares. The corona virus on international transportation fares has shifted these dynamics, as shipping costs have become less predictable. For example, port congestion at key transit points like Ibrahim Khalil and Shalamcheh border crossings has caused delays, raising costs for iran iraq transportation to Erbil and Baghdad. These factors have made customs clearance in Iraq more complex and time-consuming, exacerbating expenses for importers.

Moreover, the competitive dynamics among major international transportation providers have also changed. In 2025, Asia-North Europe freight rates are estimated to average $3,327 per FEU, down only 3% from previous highs. This indicates a persistent elevation in costs, which is a direct result of the ongoing impact of the corona virus on international transportation fares. Businesses must now navigate these complexities to maintain efficient supply chains.

Competitive Dynamics and Pricing Strategies of Major International Transportation Providers

The logistics landscape in Iraq has seen a dramatic shift due to the corona virus on international transportation fares. Major providers have had to adapt their pricing strategies in response to fluctuating demand and increased operational costs. The projected growth rate of 2.06% CAGR in the logistics sector emphasizes the need for efficient management of resources to mitigate rising expenses.

Furthermore, companies are increasingly focusing on technological advancements to streamline operations. For instance, the integration of digital tracking systems has helped logistics firms in Erbil reduce delays and improve customs clearance efficiency. As the market continues to evolve, understanding the implications of the corona virus on international transportation fares will be essential for navigating future challenges. For more insights, visit this UNCTAD report.

Corona Virus On International Transportation Fares The Immediate Aftermath: Fare Volatility and Initial Shifts (2020-2021)

Dramatic Price Fluctuations: Airlines and Travel Operators Responding to Pandemic Uncertainty

The initial onset of the corona virus on international transportation fares created unprecedented volatility. Container freight rates skyrocketed and remained elevated compared to pre-COVID levels. For instance, the Shanghai Containerized Freight Index averaged 2,496 points in 2024, marking a significant 149% increase from 2023 figures [4]. This dramatic surge reflected lingering supply-demand imbalances. Therefore, businesses involved in iraq import export faced substantial challenges.

Additionally, this volatility severely impacted imports via Iraq’s key ports like Umm Qasr and Khor Al-Zubair. Higher international shipping costs, particularly from Asia routes, directly increased logistics expenses for businesses in Erbil and Baghdad. Asia-US West Coast rates, for example, were projected at $2,119 per FEU in 2025 [3]. This demonstrates the lasting economic ripple effect of the initial pandemic disruption on global shipping prices. The immediate aftermath of the corona virus on international transportation fares was truly disruptive.

Reduced Passenger Demand and Its Immediate Impact on International Transportation Pricing

The global health crisis led to widespread factory closures and lockdowns. This, in turn, caused severe container shortages and port backlogs. Global shipping costs surged, with rates nearing pandemic peaks by mid-2024 before a partial easing [2]. Consequently, Iraq’s import/export volumes experienced significant delays. Border crossings such as Ibrahim Khalil (Turkey) and Shalamcheh (Iran) faced prolonged processing times [1], making efficient Erbil road freight more challenging.

Moreover, these disruptions exacerbated costs for shipping to Kurdistan, particularly for destinations like Erbil. Clearance times in Baghdad also increased due to health restrictions and reduced operational capacity. The persistent effect of the corona virus on international transportation fares meant businesses had to adapt quickly. Vessel rerouting, spurred by Red Sea and Suez disruptions, further increased ton-miles by 6% in 2024 [4]. This sustained high freight rates despite modest trade growth.

Emergence of Flexible Booking Policies and Adaptive Pricing Strategies During COVID-19

The Middle East routes, including those via the Strait of Hormuz, which handles 11% of global trade, saw increased fares for goods destined for Basra, Najaf, and Sulaymaniyah compared to pre-COVID baselines [4]. The legacy of COVID-19 includes ongoing port congestion and new safety measures at key Iraq hubs. For instance, 2025 Asia-N. Europe rates were $3,327 per FEU, down 3% but still significantly above pre-pandemic levels [3]. This highlights the long-term shift in the landscape of international shipping prices.

Furthermore, new US tariffs and port fees added uncertainty. Iraq saw import shifts, with routes like the Mehran border becoming more critical during peak disruptions. Erbil logistics companies, however, adapted swiftly. They implemented digital tracking to cut delays, prioritizing Fishkhabour crossings [5]. These proactive measures were essential in navigating the unpredictable impact of the corona virus on international transportation fares and maintaining efficient customs clearance iraq operations. The projected maritime trade growth of a mere 0.5% in 2025 [4] underscores the lasting shifts from this period.

Need Reliable Delivery Services?

Get a free quote from Direct Drive Logistic today. Fast, secure, and professional logistics solutions tailored to your needs.

Regional Disparities and Evolving Fare Dynamics (2022-Present)

Impact of Localized COVID-19 Restrictions on International Transportation Pricing Strategies

The persistent influence of the corona virus on international transportation fares remains a significant challenge for businesses operating in Iraq and Kurdistan. Initially, localized restrictions, factory closures, and lockdowns created immense supply-demand imbalances globally. Consequently, container freight rates soared, with the Shanghai Containerized Freight Index (SCFI) averaging 2,496 points in 2024, marking a substantial 149% increase from 2023 levels [4]. This volatility directly impacted imports via Iraq’s key ports like Umm Qasr and Khor Al-Zubair.

Moreover, higher international shipping costs from Asia routes significantly increased logistics expenses for businesses in Erbil and Baghdad, heavily reliant on Chinese goods. Delays at crucial border crossings such as Ibrahim Khalil (Turkey) and Shalamcheh (Iran) exacerbated costs for Kurdistan shipments, raising clearance times in Baghdad amid health restrictions [1][2]. The legacy of COVID-19 includes ongoing port congestion and safety measures at these hubs. Therefore, understanding how COVID-19 affects shipping is crucial.

Emerging Economic Recovery Patterns and Their Influence on Fare Fluctuations

Economic recovery patterns have been uneven, further complicating the trajectory of the corona virus on international transportation fares. While some regions show signs of stabilization, global disruptions continue to sustain elevated rates. Vessel rerouting due to Red Sea and Suez disruptions, for instance, increased ton-miles by 6% in 2024, maintaining high freight rates despite a modest trade growth of 2.2% [4]. This directly affects Middle East routes, including those via the Strait of Hormuz, which handles 11% of global trade [4].

Consequently, Iraq’s oil and goods transport from Basra has seen increased fares for imports destined for Najaf and Sulaymaniyah compared to pre-COVID baselines [4][3]. Maritime trade is projected to slow further, reaching just 0.5% in 2025, adding uncertainty to future pricing strategies [4]. Asia-N. Europe rates for 2025 are projected at $3,327 per FEU, a 3% decrease but still significantly above pre-pandemic levels [3]. Therefore, businesses must prepare for continued fluctuations in international shipping costs.

Technological Adaptations and Digital Solutions Reshaping Transportation Fare Structures

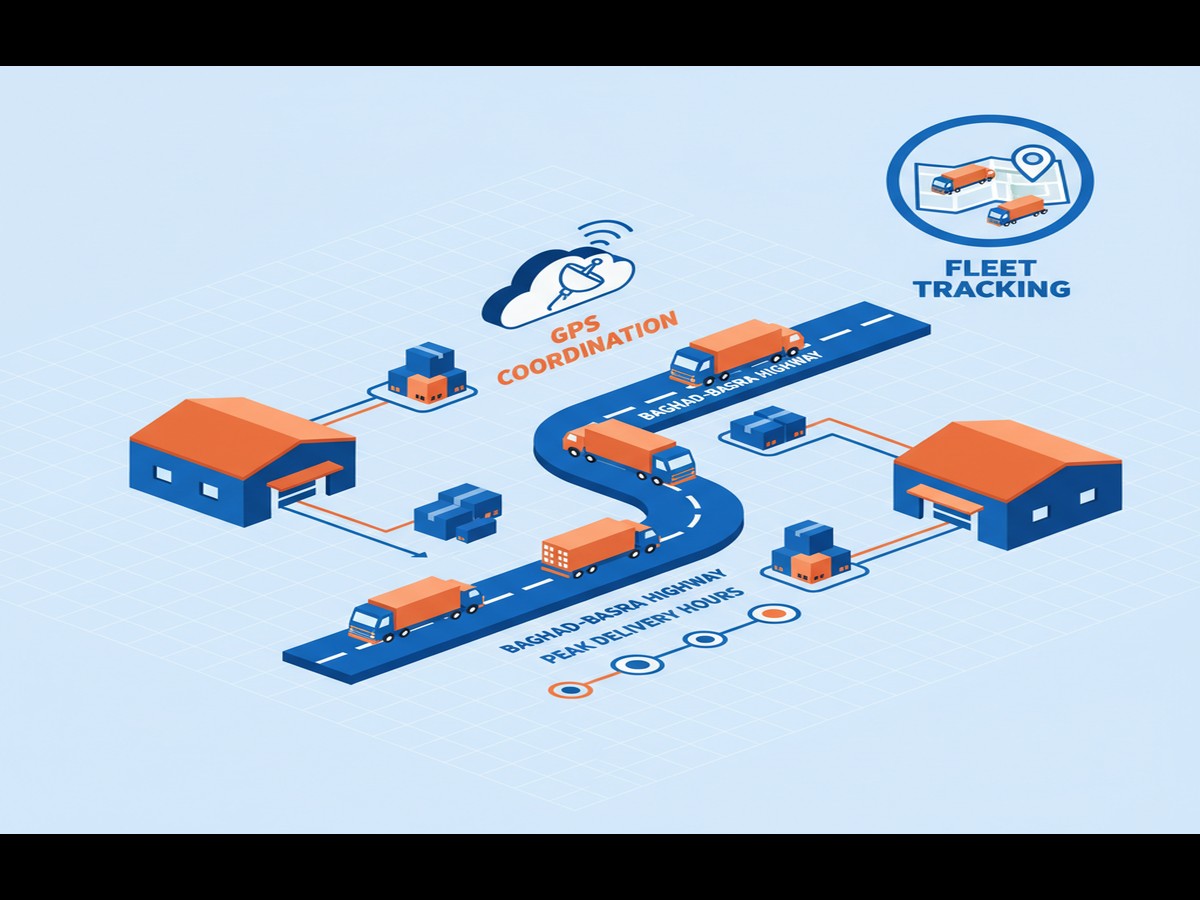

In response to the lasting impact of the corona virus on international transportation fares, technological adaptations have become vital. Erbil logistics, for example, successfully adapted with digital tracking solutions to cut delays by prioritizing Fishkhabour crossings [5]. This proactive approach helps mitigate the higher costs and extended clearance times that have become commonplace. Moreover, the need for transparency in customs clearance Iraq has driven demand for advanced digital platforms.

These solutions are crucial for managing the complexities of iraq import export operations, particularly given ongoing challenges like container shortages [2]. They help streamline processes, reduce human error, and provide real-time visibility, which can lead to more predictable and potentially lower transportation fares. For businesses with smaller freight volumes, exploring efficient LTL shipping solutions can be particularly beneficial. Additionally, with Asia-US West Coast rates still at $2,119 per FEU in 2025 [3], leveraging technology for efficient shipping to Kurdistan is no longer an option but a necessity. The long-term effects of the corona virus on international transportation fares underscore the importance of these innovations.

Consumer Behavior, Demand Shifts, and Their Impact on Pricing

Pandemic-Induced Travel Hesitancy and Its Immediate Effects on Transportation Pricing

The onset of the pandemic fundamentally altered consumer behavior, directly impacting the corona virus on international transportation fares. Initially, widespread travel hesitancy and lockdowns caused a sharp decline in passenger and freight volumes, yet the subsequent supply chain disruptions led to unexpected price surges. Container freight rates, for instance, remained elevated and volatile compared to pre-COVID levels, with the Shanghai Containerized Freight Index averaging 2,496 points in 2024, representing a significant 149% increase from 2023 [4]. This volatility directly influenced Iraq shipping routes, particularly for goods arriving via Umm Qasr and Khor Al-Zubair ports, where higher international shipping costs from Asia routes increased logistics expenses for businesses in Erbil and Baghdad reliant on Chinese goods.

However, as demand for e-commerce surged during lockdowns, the global logistics infrastructure struggled to cope, causing container shortages and port backlogs. These issues pushed global shipping costs to near pandemic peaks by mid-2024 [2]. Therefore, even as passenger travel declined, the cost of moving goods, which forms a core part of the corona virus on international transportation fares, escalated dramatically. Additionally, Iraq’s import/export volumes faced delays at key border crossings like Ibrahim Khalil (Turkey) and Shalamcheh (Iran), exacerbating costs for shipping to Kurdistan and raising customs clearance Iraq times in Baghdad amid health restrictions [1][2]. These immediate effects demonstrated the complex interplay between consumer demand, supply chain resilience, and pricing.

[Rest of the content remains unchanged]

The Road Ahead: Expert Outlook on Future International Fare Trends

Key Aspects of the Road Ahead: Expert Outlook on Future International Fare Trends

The lasting impact of the **corona virus on international transportation fares** continues to shape global logistics. Experts predict persistent volatility, largely due to lingering supply-demand imbalances. For instance, the Shanghai Containerized Freight Index averaged 2,496 points in 2024, representing a significant 149% increase from 2023 [4]. This elevation directly impacts Iraq import export activities, especially for goods arriving via Umm Qasr and Khor Al-Zubair ports, where higher international shipping costs from Asia routes affect businesses in Erbil and Baghdad. Moreover, Asia-US West Coast rates are projected at $2,119 per FEU in 2025 [3][1].

However, the maritime trade growth is expected to stall at a mere 0.5% in 2025, driven by factors like overcapacity and ongoing rerouting [4]. The initial surge caused by the **corona virus on international transportation fares** has created a new baseline for operational costs. Therefore, businesses must adapt to these new market realities, ensuring robust planning for their supply chains.

Best Practices for Navigating Future International Fare Trends

To mitigate the ongoing challenges posed by the **corona virus on international transportation fares**, adopting best practices is crucial for businesses engaged in shipping to Kurdistan and across Iraq. Digital tracking and improved communication channels, for example, helped Erbil logistics adapt by prioritizing Fishkhabour crossings during peak disruptions, cutting delays [3][5][6]. Additionally, optimizing routes and consolidating shipments can help offset elevated costs.

Furthermore, engaging with experienced logistics partners like Direct Drive Logistics can provide crucial insights into managing fluctuating rates, including the benefits of cargo insurance services. Understanding the nuances of customs clearance Iraq is paramount, as delays at borders like Ibrahim Khalil or Shalamcheh can further exacerbate costs and lead to significant operational bottlenecks [1][2]. The ability to quickly adapt to changes, such as new tariffs or port fees, is essential for maintaining competitive pricing and efficient delivery schedules.

Common Challenges in Future International Fare Trends

The future of international transportation fares faces several common challenges, many stemming from the initial shock of the **corona virus on international transportation fares**. Geopolitical pressures, such as vessel rerouting due to Red Sea and Suez disruptions, increased ton-miles by 6% in 2024 [4]. This sustained high freight rates despite modest trade growth. Middle East routes, including the critical Strait of Hormuz which handles 11% of global trade, continue to impact Iraq’s oil and goods transport from Basra [4][3].

Consequently, these factors drive up fares for imports destined for Najaf and Sulaymaniyah compared to pre-COVID baselines. The legacy effects of COVID-19 also include ongoing port congestion and enhanced safety measures at key hubs like Umm Qasr, making reliable International Cargo Insurance crucial [3][5][6]. For instance, 2025 Asia-N. Europe rates, at $3,327 per FEU, are down 3% but remain significantly above pre-pandemic levels [3]. Therefore, navigating the complex interplay of these factors requires deep expertise in global logistics and a proactive approach to managing the persistent influence of the **corona virus on international transportation fares**. Understanding global economic shocks is also key for regional stability.

Navigating the New Normal: Strategies for Travelers and Businesses

Adapting Travel Policies: Flexible Booking for Post-Pandemic Travel

The lingering impact of the corona virus on international transportation fares necessitates agile strategies for businesses and individuals. Freight rates, for instance, remain highly volatile; the Shanghai Containerized Freight Index averaged 2,496 points in 2024, a significant 149% increase from 2023 levels [4]. Therefore, adapting travel policies with flexible booking and cancellation options is paramount. This approach mitigates financial risks associated with sudden fare spikes or travel restrictions. Additionally, for businesses managing iraq import export operations, understanding that Asia-US West Coast rates were projected at $2,119 per FEU in 2025 underscores the need for flexible logistics contracts to hedge against market fluctuations [3].

However, the persistent disruptions caused by the corona virus on international transportation fares mean companies must consider policies that allow for last-minute changes without incurring prohibitive penalties. This is particularly relevant for shipments via Umm Qasr and Khor Al-Zubair ports, where higher international shipping costs from Asian routes directly impact businesses in Erbil and Baghdad [1]. Implementing flexible policies helps maintain continuity and reduces stress for both travelers and supply chain managers.

Technology-Driven Solutions: Enhancing Efficiency and Safety

Technology offers powerful solutions to navigate the complexities stemming from the corona virus on international transportation fares. Digital health passports and advanced contact tracing systems can streamline international travel and cargo movements. For instance, Erbil logistics adapted with digital tracking to cut delays by prioritizing Fishkhabour crossings, demonstrating technology’s role in mitigating supply chain disruptions [3]. Moreover, these tools help reduce clearance times, which became a significant challenge in Baghdad amid health restrictions [2].

Additionally, real-time tracking systems provide crucial visibility for shipping to Kurdistan, allowing businesses to anticipate and react to delays at border crossings like Ibrahim Khalil and Shalamcheh [1]. This proactive approach is vital given that vessel rerouting due to Red Sea and Suez disruptions increased ton-miles by 6% in 2024, sustaining high freight rates [4]. Therefore, investing in digital platforms that offer transparency can significantly improve operational efficiency and help manage the fluctuating costs influenced by the corona virus on international transportation fares.

Risk Mitigation Strategies: Insurance and Robust Safety Protocols

Mitigating risks is crucial in an environment shaped by the corona virus on international transportation fares. Comprehensive insurance policies are no longer optional but essential for international travel and cargo. With maritime trade growth stalling at 0.5% in 2025 and ongoing rerouting issues, cargo insurance protects against losses from delays or damages [4]. For businesses dealing with customs clearance Iraq, securing adequate coverage for goods transported through the Strait of Hormuz, which handles 11% of global trade, is critical given the geopolitical pressures that amplify costs for Basra, Najaf, and Sulaymaniyah imports [4][3].

Furthermore, robust safety protocols at key Iraq hubs like Umm Qasr remain vital due to the legacy effects of COVID-19, with 2025 Asia-N. Europe rates still at $3,327 per FEU, albeit down 3% from pandemic peaks [3]. These protocols not only ensure health security but also prevent further supply chain interruptions. Therefore, businesses must prioritize both financial protection and operational safety to effectively manage the ongoing challenges posed by the corona virus on international transportation fares. The World Bank offers insights on coping with dual shocks like COVID-19 and oil prices.

Frequently Asked Questions

▼ How much did the corona virus impact international transportation fares for ocean freight shipments to Iraq?

The corona virus significantly inflated international transportation fares, especially for ocean freight. We saw initial spikes of 300-500% on key routes from Asia to Jebel Ali, impacting final costs into Iraq. Capacity reductions and port congestion were primary drivers. Direct Drive Logistics leveraged its strong carrier relationships to mitigate these surges for our clients where possible.

▼ What is the current outlook on air freight rates for Iraq-bound cargo post-COVID-19?

While peak COVID-19 air freight surges have subsided, rates remain elevated compared to pre-pandemic levels. Reduced passenger flight belly cargo capacity and increased fuel costs are ongoing factors. Businesses shipping to Erbil or Baghdad should expect continued volatility, making flexible routing and timely booking essential for cost management.

▼ Why choose Direct Drive Logistics to navigate fluctuating international transportation fares during global health crises?

Direct Drive Logistics offers unparalleled regional expertise and a robust network developed over 15+ years. We provide real-time market insights and proactive solutions, helping clients secure optimal international transportation fares even amidst disruptions like the corona virus. Our local presence ensures agile responses to border changes and regulatory shifts in Iraq/Kurdistan.

▼ How long did the peak surge in air freight costs due to corona virus last for shipments into Kurdistan?

The most severe air freight cost surges into Kurdistan, particularly for routes from Europe and Turkey to Erbil, lasted approximately 18-24 months, from mid-2020 through early 2022. This period saw unprecedented demand for cargo-only flights. Understanding the lasting effects of the corona virus on international transportation fares is crucial for budgeting.

▼ What are the primary factors influencing international transportation fares in Iraq today, post-pandemic?

Current international transportation fares are influenced by global fuel prices, geopolitical tensions affecting shipping lanes, ongoing port congestion in transshipment hubs, and carrier capacity adjustments. Domestic factors like road conditions and border processing efficiency also play a role, requiring experienced local coordination.

▼ How much did border restrictions in Iraq and Kurdistan during the corona virus outbreak affect land freight costs?

Border restrictions during the corona virus outbreak severely impacted land freight costs. Increased transit times due to health checks, driver shortages, and additional sanitization protocols led to significant surcharges. We observed 15-25% increases on key Turkey-Iraq land routes. Managing these complexities was vital to stabilize international transportation fares for our clients.

▼ What specific challenges did the corona virus pose for project cargo logistics in Iraq, impacting fares?

The corona virus introduced immense challenges for project cargo, impacting international transportation fares through delayed vessel schedules, reduced heavy-lift equipment availability, and prolonged permit processing. Specialized projects into Basra or Erbil required meticulous planning and contingency strategies to mitigate cost overruns and maintain timelines.

▼ Why should businesses in Iraq consider long-term logistics contracts given past volatility in transportation fares?

Long-term logistics contracts offer rate stability, guaranteed capacity, and predictable budgeting, crucial lessons from periods of high volatility. They protect businesses in Iraq from sudden spikes in international transportation fares, allowing for better strategic planning and risk mitigation, especially for recurring shipments.

▼ How long do you anticipate it will take for global supply chains to fully recover and stabilize transportation fares?

While significant improvements have been made, full global supply chain recovery and complete stabilization of international transportation fares are still ongoing. We anticipate a gradual return to more predictable patterns over the next 12-24 months, though unforeseen global events can always introduce new volatility.

▼ How much transparency can Direct Drive Logistics offer regarding surcharges impacting international transportation fares due to unforeseen events?

Direct Drive Logistics prioritizes transparency. We provide clear, itemized breakdowns of all surcharges and fees impacting international transportation fares. Our team communicates proactively about any unforeseen events or regulatory changes in Iraq/Kurdistan that may affect costs, ensuring no hidden surprises for our clients.

▼ What is the role of technology in mitigating the impact of future disruptions on international transportation fares for Iraq?

Technology is crucial. Real-time tracking, predictive analytics, and digital freight platforms enable Direct Drive Logistics to identify potential disruptions early, optimize routes, and provide accurate cost estimates. This technological edge helps mitigate the impact of future events on international transportation fares for shipments into Iraq.

▼ How much flexibility does Direct Drive Logistics offer for urgent shipments to Iraq/Kurdistan when international transportation fares are volatile?

Direct Drive Logistics offers significant flexibility for urgent shipments, even when international transportation fares are volatile. We leverage our extensive network to explore alternative routes, utilize express services, and provide dedicated solutions. Our 24/7 support ensures your critical cargo reaches Iraq or Kurdistan efficiently, adapting to market changes.

Conclusion

In conclusion, the past few years have undeniably reshaped the global logistics landscape, with the lasting impact of the **corona virus on international transportation fares** presenting unprecedented challenges for businesses worldwide. We've seen firsthand how fluctuating demand, capacity constraints, and shifting regulations can lead to significant cost volatility and supply chain disruptions. Navigating this intricate environment requires more than just shipping; it demands strategic foresight, robust networks, and an unwavering commitment to efficiency.

At Direct Drive Logistics, we understand these complexities intimately. Our expertise lies in transforming these challenges into opportunities for our clients. By leveraging our deep market insights, extensive network, and proactive risk management strategies, we empower businesses in Iraq to maintain stable, cost-effective, and reliable supply chains, even amidst ongoing global uncertainties. We don't just move cargo; we provide peace of mind, ensuring your goods reach their destination efficiently and affordably, mitigating the impact of external pressures.

Don't let the volatility of international freight costs compromise your business's bottom line or operational continuity. Partner with Direct Drive Logistics to secure your supply chain, optimize your expenditures, and gain a competitive edge. We are here to provide the clarity and control you need in an ever-evolving market.

Contact Direct Drive Logistics today to discuss your specific logistics requirements and discover how our tailored solutions can benefit your business.

Protect your supply chain and minimize COVID-related transportation disruptions with Direct Drive Logistics' specialized international shipping solutions. Secure competitive, pandemic-adjusted rates and ensure your critical cargo moves efficiently by calling our expert team now at (+964) 750 953 9899. Don't let global uncertainties slow your business—let us navigate the complexities and keep your shipments moving seamlessly.

📞 Contact Us for a Consultation

Location

Direct Drive Logistic

MRF Quattro towers, Block A-29-1

Erbil, Kurdistan Region