The Customs Clearance Process In Iraq – Complete Guide…

Discover how the customs clearance process in iraq can transform your logistics operations with this guide provides an unparalleled, practical, and up-to-date roadmap for businesses navigating the intricate iraqi customs landscape, including specific insights into kurdistan, to ensure compliant and efficient cross-border logistics. Iraq, a nation undergoing significant economic revitalization and infrastructural development, represents a market of immense potential for international trade. However, unlocking this potential hinges critically on a thorough understanding and masterful execution of its import and export procedures. For any enterprise engaged in cross-border commerce with Iraq, whether importing vital goods, machinery, or consumer products, or utilizing its strategic location as a transit hub, navigating the complexities of its customs regulations is not merely a procedural step but a strategic imperative. Efficient **customs clearance**, which involves the preparation and submission of documentation required to facilitate the movement of goods across international borders, is the linchpin that connects global supply chains to local markets, directly impacting delivery times, operational costs, and ultimately, market competitiveness. Delays at the border can ripple through an entire supply chain, leading to increased demurrage charges, missed deadlines, and damaged business relationships. Conversely, a streamlined process can provide a significant competitive advantage, ensuring goods reach their destination promptly and cost-effectively, thereby enhancing customer satisfaction and fostering sustainable growth in a challenging yet rewarding environment.

This comprehensive guide is meticulously designed to demystify the Iraqi customs environment, offering clarity on everything from foundational regulations to the nuances of regional specificities, particularly within the Kurdistan Region of Iraq. Understanding the customs clearance process in iraq is essential. We recognize that the journey of goods through Iraqi customs can often seem daunting, characterized by evolving policies, diverse interpretations, and the critical need for precise documentation. Consider the **Bill of Lading (B/L)**, a fundamental legal document issued by a carrier to a shipper, which details the type, quantity, and destination of goods being shipped, serving as a receipt of freight services, a contract of carriage, and a document of title. Errors or omissions in such vital paperwork can lead to significant hold-ups. This is precisely why understanding the ‘why’ behind each step of the customs clearance process in Iraq is as important as understanding the ‘how.’ We will delve into why this topic matters so profoundly to logistics professionals and business owners alike, illustrating how mastery of these procedures can mitigate risks, reduce unexpected expenses, and accelerate market entry. The role of a competent **customs broker**, an individual or firm licensed by the customs authority to assist importers and exporters in meeting government requirements for importing and exporting goods, is often indispensable in navigating these intricate requirements, especially in regions like Erbil where local expertise can make all the difference. This introduction sets the stage for a deep dive into the practicalities, ensuring you are equipped with the knowledge to make informed decisions and optimize your logistics operations.

To truly master this complex customs landscape, this article offers an unparalleled, practical, and up-to-date roadmap for businesses. It begins by Demystifying Customs Clearance in Iraq: An Introduction, followed by a thorough Understanding Iraq’s Import Regulations and Customs Landscape. We will then detail the Essential Documentation for Customs Clearance in Iraq, a critical section that will illuminate the precise paperwork required, including the often-complex requirements related to product classification using the **Harmonized System (HS) Code**, an internationally standardized numerical method of classifying traded products, used by customs authorities worldwide to identify products for duties and taxes. Subsequently, we will guide you through Calculating and Paying Iraq Import Duties and Taxes, where understanding various levies like **import duties**, which are taxes levied on goods imported into a country, is paramount to accurate financial planning and avoiding unexpected costs. The core of our discussion will be A Step-by-Step Guide to the Customs Clearance Process in Iraq, offering a granular view of each stage. Recognizing the distinct administrative structures, we dedicate a section to the Specifics of Kurdistan Customs Clearance: What You Need to Know, and underscore The Critical Role of a Customs Broker in Erbil and Across Iraq. We will also address Common Challenges in Iraqi Customs and How to Mitigate Them, offer strategies for Optimizing Your Shipping to Iraq for Smoother Clearance, and emphasize Ensuring Compliance: Avoiding Delays and Penalties. Finally, we will explore Key Updates and Future Trends in Iraqi Customs Procedures, culminating in a Conclusion: Mastering Iraqi Customs for Successful Logistics. Whether you’re a seasoned logistics professional or a business owner venturing into the Iraqi market for the first time, this guide promises to be an invaluable resource, providing actionable insights to enhance your operations and turn potential challenges into strategic advantages. Prepare to transform your approach to the customs clearance process in Iraq, moving from uncertainty to confident execution.

Introduction to Customs Clearance in Iraq: Why it Matters

Understanding the Core Process of Iraqi Customs Clearance

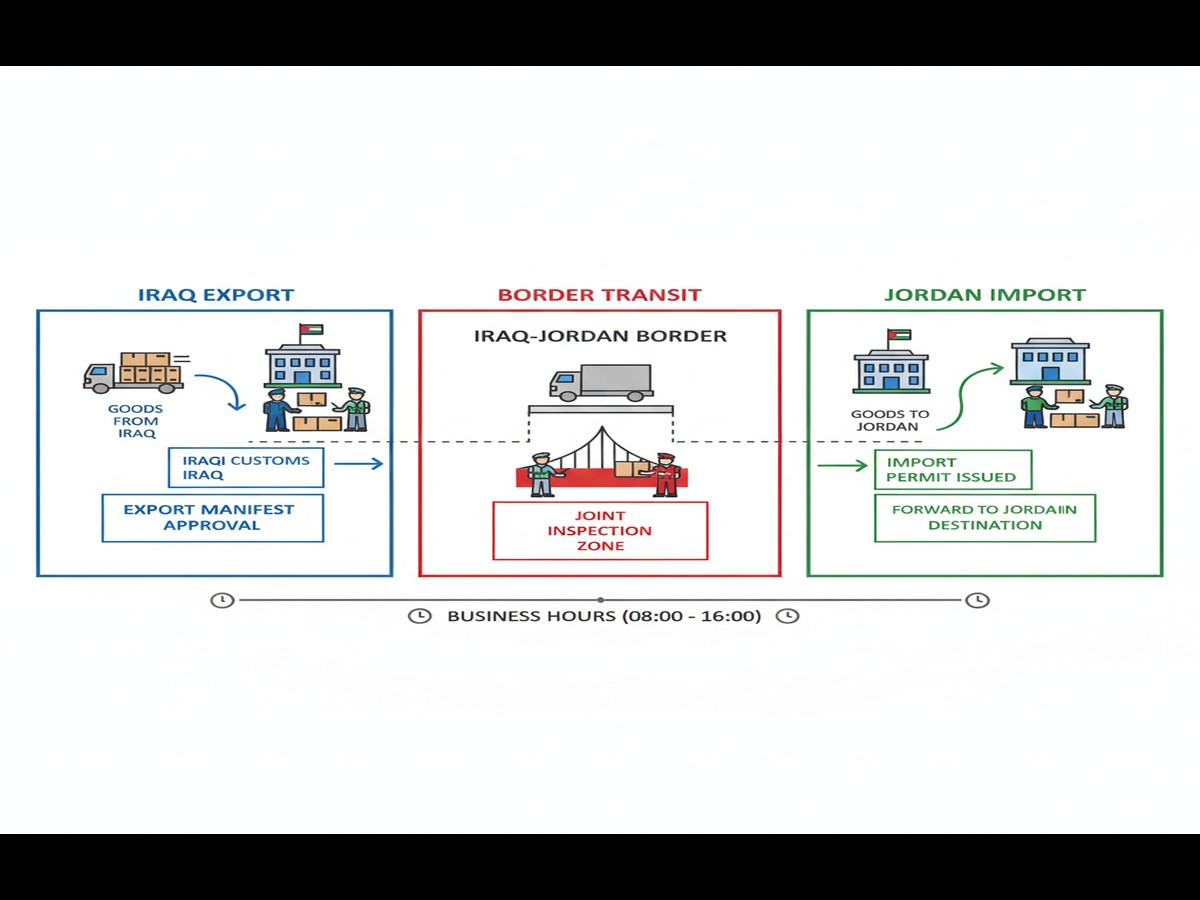

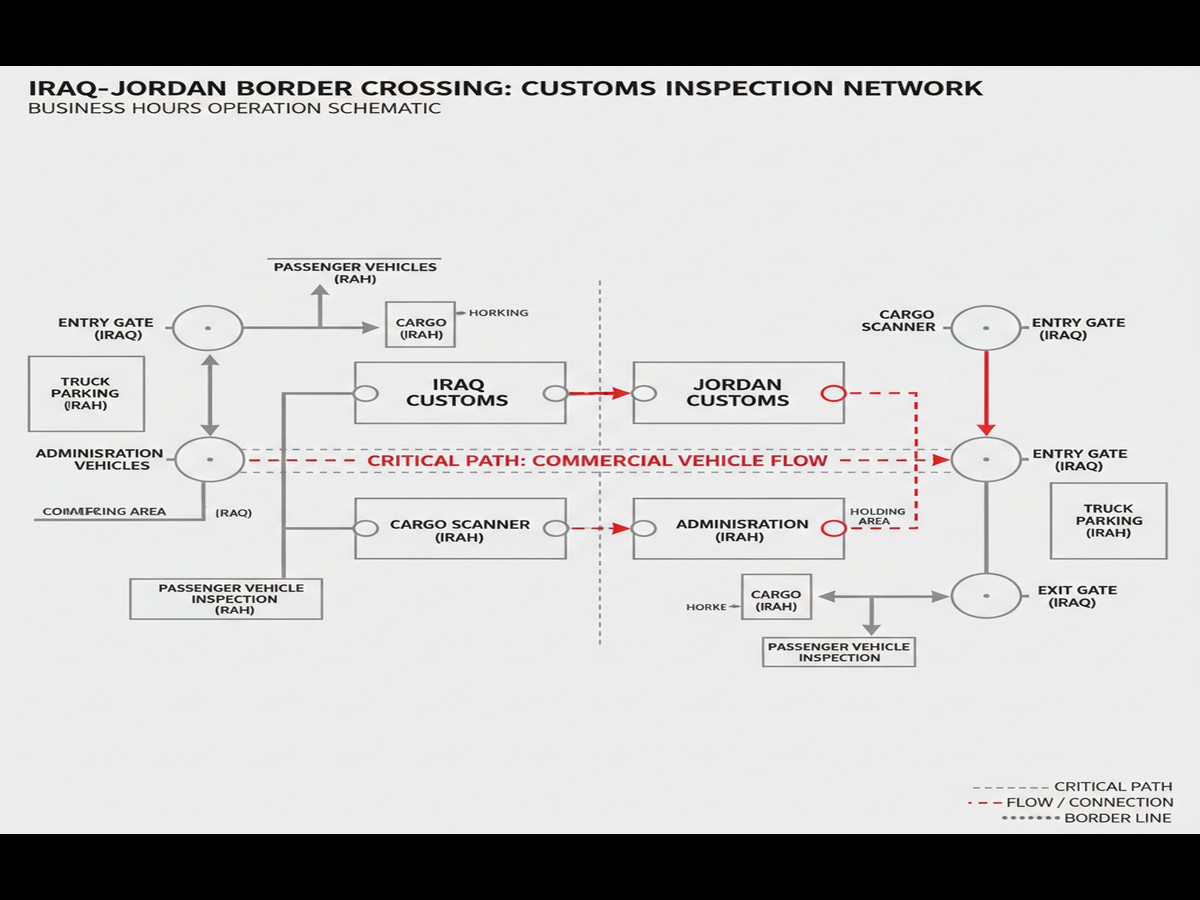

Navigating the customs clearance process is essential for any business engaged in import or export activities. This complex procedure ensures compliance with stringent import regulations iraq, protecting national security and economic interests. Historically, manual checks often led to significant delays. However, Iraq is now rolling out automation, pre-customs declarations, and a unified customs tariff, aiming to streamline procedures across all border points. From December 1, 2025, a Pre-Customs Declaration becomes mandatory for financial transfers and customs clearance [AHK Iraq / Iraqi Embassy Berlin (2025)].

Additionally, a new unified customs tariff will be enforced at all borders from July 1, 2025. Therefore, all bills of lading and manifests must carry valid 6-digit HS codes, with penalties for non-compliance [Ocean Network Express (2025)]. This modernization effort is designed to significantly reduce manual paperwork, especially at key gateways like Umm Qasr and land borders. It will bring Iraq’s average clearance times closer to GCC benchmarks, which typically range from 1 to 3 days for compliant shipments.

Ensuring Seamless Trade and Mitigating Costly Delays for Businesses

Efficient management of the Iraq customs process directly translates to reduced costs and improved market competitiveness for businesses. Rapid growth in import volumes and customs revenue is now compelling Iraq Customs and KRI Customs to modernize their operations and tighten compliance. For instance, Iraq’s seaports handled an impressive **22.4 million tons of cargo and 1,522 ships in H1 2025**, demonstrating enhanced operational efficiency at Umm Qasr and Khor Al-Zubair [AHK Iraq (2025)].

Furthermore, customs revenue reached a substantial **USD 1.68 billion in 2025**, a marked increase attributed to automation and more effective duty collection. With Iraq’s merchandise imports hovering around **USD 60–70 billion annually** [World Bank / UN Comtrade], faster, more predictable clearance is a critical competitiveness issue. Therefore, engaging expert customs brokerage erbil services is crucial for navigating these evolving demands and avoiding costly delays.

Strategic Impact on Supply Chain Efficiency

The strategic impact of an optimized customs clearance process in Iraq extends throughout the entire supply chain. Modern logistics demands swift movement of goods, and the growth of e-commerce and express shipments has raised expectations for rapid delivery. Many businesses now expect end-to-end delivery within **2–5 days**, pushing customs authorities to simplify procedures.

Additionally, the adoption of digital customs tools is transforming how goods are processed, making the entire journey more transparent and predictable. Therefore, understanding and adapting to these changes in the customs clearance process in Iraq is vital for maintaining a competitive edge. Ensuring smooth shipping to iraq requires not only adherence to current regulations but also foresight into upcoming reforms. Ultimately, efficient customs operations contribute significantly to overall supply chain resilience and customer satisfaction.

Essential Documents and Information for Iraqi Customs

Key Aspects of Essential Documents and Information for Iraqi Customs

Navigating the customs clearance process demands meticulous attention to detail, especially with recent reforms. From 1 December 2025, a **Pre-Customs Declaration** becomes mandatory for financial transfers and customs clearance, aiming to significantly cut delays at border crossings [AHK Iraq / Iraqi Embassy Berlin]. This critical step supports the broader automation drive across the nation. Therefore, shippers must prepare for this new requirement well in advance.

Additionally, a new **unified customs tariff** takes effect at all borders from 1 July 2025. All bills of lading and manifests must carry valid 6-digit HS codes. Non-compliance will incur penalties, highlighting the importance of precise commodity classification. This standardization streamlines the customs clearance process in Iraq, particularly at key entry points like Umm Qasr and land borders. These initiatives are designed to reduce manual checks and “back-and-forth” paperwork, making import regulations Iraq more efficient.

Best Practices for Essential Documents and Information for Iraqi Customs

To ensure a smooth customs clearance process, adopting best practices is paramount. The country’s seaports handled an impressive **22.4 million tons of cargo** and **1,522 ships in H1 2025** [AHK Iraq], reflecting growing import volumes. This substantial activity underscores the need for accurate and complete documentation. Therefore, businesses should collaborate closely with experienced customs brokerage Erbil services. These experts understand the evolving requirements and can help avoid costly delays. Ensuring all documents, including invoices, packing lists, and certificates of origin, are consistent and error-free is vital. Additionally, utilizing digital customs tools where available can significantly expedite submissions. This proactive approach supports a more predictable and efficient customs clearance process in Iraq.

Common Challenges in Essential Documents and Information for Iraqi Customs

Despite modernization efforts, common challenges can still complicate the customs clearance process in Iraq. Iraq’s merchandise imports hover around **USD 60–70 billion annually** [World Bank / UN Comtrade], reflecting significant trade volumes. This volume places immense pressure on the system. Moreover, the rise of e-commerce and express shipments now creates expectations for **2–5 day end-to-end delivery**, a tight window for traditional customs procedures.

However, the ongoing reforms aim to address these issues. The mandatory **6-digit HS codes** and pre-customs declarations are designed to reduce discrepancies. Importers often face challenges with inconsistent documentation or a lack of understanding of specific import regulations Iraq. Therefore, investing in robust internal compliance and leveraging experienced partners for shipping to Iraq is crucial. Over time, these measures are expected to bring Iraq’s average clearance times closer to GCC benchmarks, typically **1–3 days** for compliant shipments.

The Customs Clearance Process In Iraq Key Players: Navigating the Iraqi Customs Authority and Beyond

Key Aspects of Navigating Iraqi Customs Authority

Successfully managing the customs clearance process requires a deep understanding of the key governmental bodies and recent reforms. The Iraqi Customs Authority and KRI Customs are central, with the Ministry of Finance playing a critical oversight role. Iraq is actively modernizing, rolling out automation, pre-customs declarations, and a unified customs tariff to standardize procedures across all border points. Notably, a Pre-Customs Declaration becomes mandatory for financial transfers and customs clearance from December 1, 2025, as part of a phased reform designed to cut delays and support automation at border crossings, according to [AHK Iraq / Iraqi Embassy Berlin].

Additionally, the Ministry of Finance is enforcing a new unified customs tariff at all borders from July 1, 2025. Therefore, all bills of lading and manifests must carry valid 6-digit HS codes, with penalties for non-compliance, as highlighted by [Ocean Network Express]. This initiative is expected to reduce manual checks and “back-and-forth” paperwork, especially at Umm Qasr and land borders. Over time, these changes aim to bring Iraq’s average clearance times closer to GCC benchmarks, typically 1–3 days for compliant shipments. Understanding these evolving import regulations Iraq is crucial for smooth operations.

Best Practices for Streamlining the Customs Clearance Process in Iraq

To navigate the evolving landscape of the customs clearance process effectively, adopting best practices is essential. Rapid growth in import volumes and customs revenue is pressing both Iraqi and KRI Customs to modernize and tighten compliance. For instance, Iraq’s seaports handled an impressive **22.4 million tons of cargo and 1,522 ships in H1 2025**, reflecting improved operational efficiency at Umm Qasr and Khor Al-Zubair [AHK Iraq]. Furthermore, customs revenue reached **USD 1.68 billion in 2025**, a marked increase attributed to automation and better duty collection [Iraqi News].

Therefore, businesses must prioritize accurate documentation, particularly the mandatory 6-digit HS codes. Engaging experienced partners in customs brokerage Erbil and other key regions can significantly streamline the process. Additionally, staying informed about the latest updates from the AHK Iraq Business Newsletter is vital for compliance. Embracing digital tools and preparing for pre-customs declarations well in advance will mitigate potential delays. This proactive approach ensures shipments move efficiently through the system, minimizing costs and maximizing predictability.

Common Challenges in the Customs Clearance Process in Iraq

Despite significant modernization efforts, several challenges persist within the customs clearance process. The sheer volume of merchandise imports, estimated at around **USD 60–70 billion annually** (2023–2024 data) with top partners including China, Turkey, UAE, and Iran [World Bank / UN Comtrade], creates immense pressure on existing infrastructure and systems. While automation is being implemented, initial phases can still present complexities and require careful navigation. Businesses also face rising expectations for swift delivery, with e-commerce and express shipments driving demand for 2–5 day end-to-end delivery.

However, inconsistent application of regulations or varying interpretations at different border points can still cause delays. Therefore, selecting a knowledgeable partner for shipping to Iraq is paramount. An experienced logistics provider can anticipate potential roadblocks and ensure all import regulations Iraq are meticulously followed. Additionally, continuous monitoring of policy changes and proactive communication with customs authorities are key strategies to overcome these common challenges and ensure a more predictable customs clearance process in Iraq.

Need Reliable Delivery Services?

Get a free quote from Direct Drive Logistic today. Fast, secure, and professional logistics solutions tailored to your needs.

Step-by-Step: The Iraqi Customs Clearance Process Explained

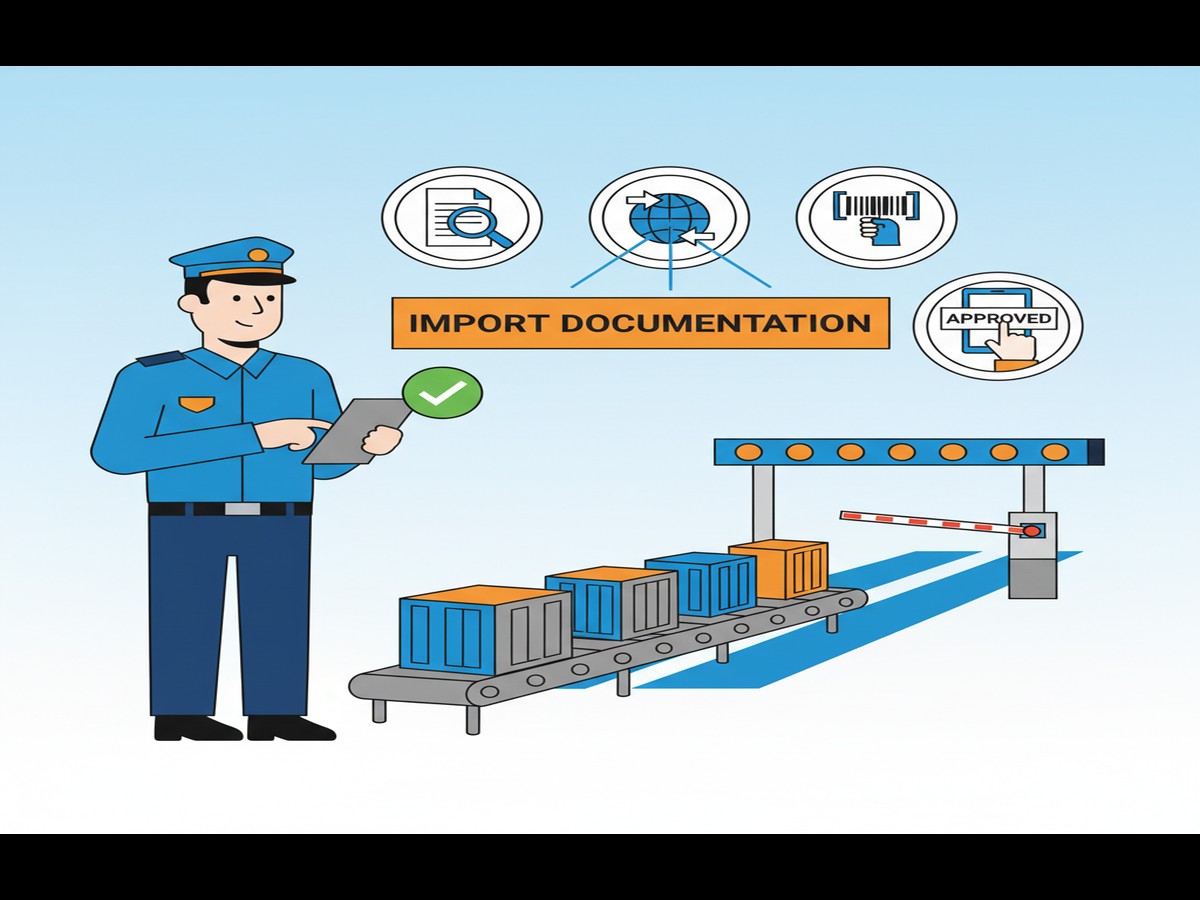

Preparing Essential Documentation and Initiating Your Customs Declaration

Navigating the complexities of the customs clearance Iraq begins long before goods arrive at the border. Importers must proactively prepare essential documentation to ensure a smooth journey. A significant reform mandates a **Pre‑Customs Declaration for financial transfers and customs clearance from 1 December 2025**, designed to significantly cut delays and bolster automation at border crossings [AHK Iraq / Iraqi Embassy Berlin (2025)]. Therefore, accurate and timely submission is paramount.

Additionally, the Ministry of Finance is enforcing a **new unified customs tariff at all borders from 1 July 2025**. This means all bills of lading and manifests must carry valid **6‑digit HS codes**, with penalties for non‑compliance [Ocean Network Express (2025)]. Adhering to these new import regulations Iraq is crucial. Experts anticipate this will reduce manual checks and “back‑and‑forth” paperwork, especially at key gateways like Umm Qasr and land borders, bringing clearance times closer to GCC benchmarks of typically 1–3 days for compliant shipments.

Navigating Goods Inspection, Valuation, and Duty Assessment

Once the initial declarations are submitted, the customs clearance Iraq moves to inspection and valuation. Growing import volumes and revenue are driving modernization efforts. For instance, Iraq’s seaports handled an impressive **22.4 million tons of cargo and 1,522 ships in H1 2025**, reflecting improved operational efficiency at Umm Qasr and Khor Al‑Zubair [AHK Iraq (2025)]. This high throughput puts pressure on customs to streamline procedures.

Furthermore, customs revenue reached **USD 1.68 billion in 2025**, a marked increase attributed to automation and better duty collection [Iraqi News (2025)]. This substantial revenue, coupled with Iraq’s merchandise imports hovering around **USD 60–70 billion annually** (2023–2024 data) [World Bank / UN Comtrade], underscores the critical need for efficient processing. Therefore, goods undergo inspection to verify declared contents against documentation. Valuation then determines the customs duty, which is now standardized under the unified tariff. A skilled customs brokerage Erbil team, for example, can significantly expedite this stage, particularly for shipping to Iraq via KRI gateways. The goal is to make the customs clearance process in Iraq as predictable as possible, aligning with expectations for 2–5 day end‑to‑end delivery driven by e‑commerce growth. You can find more details on regional business trends in the AHK Iraq Business Newsletter.

Understanding Customs Duties, Taxes, and Fees in Iraq

Defining Iraq’s Key Import Duties, Value Added Tax (VAT), and Excise Taxes

Understanding the customs clearance process in Iraq is crucial for any business engaged in international trade. Iraq is actively modernizing its import regulations. For instance, a new unified customs tariff will be enforced at all borders from 1 July 2025, as stated by [Ocean Network Express (2025)]. This aims to standardize duties and enhance predictability for shippers.

Additionally, a Pre-Customs Declaration will become mandatory for financial transfers and customs clearance from 1 December 2025, according to [AHK Iraq / Iraqi Embassy Berlin (2025)]. This reform is designed to cut delays. Consequently, all bills of lading and manifests must carry valid 6-digit HS codes, with penalties for non-compliance, streamlining the process significantly.

Iraq does not currently implement a Value Added Tax (VAT) in the same way many other countries do. However, various duties and fees are levied on imported goods. Therefore, accurate classification and documentation are paramount to navigate these charges effectively. The goal is to reduce manual checks and paperwork, especially at key entry points like Umm Qasr.

Factors Influencing Customs Valuation and Calculation of Applicable Fees in Iraq

The valuation of imported goods significantly impacts the customs duties and fees applied. Factors such as the declared value, origin, and type of goods play a critical role in this calculation. The ongoing automation efforts are improving the efficiency of the customs clearance process in Iraq.

Iraq’s seaports handled an impressive 22.4 million tons of cargo and 1,522 ships in H1 2025, reflecting improved operational efficiency at Umm Qasr and Khor Al-Zubair [AHK Iraq (2025)]. This high volume necessitates faster processing. Therefore, the automation and pre-declaration systems are vital to bring clearance times closer to GCC benchmarks, typically 1–3 days for compliant shipments.

Furthermore, customs revenue reached USD 1.68 billion in 2025 [Iraqi News (2025)], a marked increase attributed to automation and better duty collection. This substantial revenue highlights the importance of precise customs valuation. Moreover, the robust import volumes, approximately USD 60–70 billion annually in merchandise imports [World Bank / UN Comtrade], underscore the need for a streamlined and predictable customs clearance process in Iraq.

Navigating Additional Charges and Potential Exemptions for Specific Goods

Beyond standard import duties, additional charges may apply, including storage fees, inspection fees, and other administrative costs. However, certain goods may qualify for exemptions or reduced tariffs under specific agreements or government initiatives. Therefore, understanding these nuances is key to optimizing shipping to Iraq.

The growth in e-commerce and express shipments is raising expectations for 2–5 day end-to-end delivery, pushing customs authorities to simplify procedures. Consequently, modernizing the customs clearance process in Iraq is a priority for both Iraq Customs and KRI Customs. This pressure helps improve services like customs brokerage Erbil offers.

Direct Drive Logistics assists businesses in navigating these complex import regulations Iraq has implemented. By leveraging expertise in the unified customs tariff and pre-customs declaration requirements, we help expedite the customs clearance process in Iraq, ensuring compliance and minimizing delays. Our aim is to make managing the customs clearance process in Iraq as seamless as possible for our clients.

The Customs Clearance Process In Iraq Common Challenges and Solutions in Iraqi Customs Clearance

Streamlining Documentation and Navigating Bureaucratic Hurdles for Efficient Clearance

Navigating the customs clearance process in Iraq often presents complex challenges, particularly concerning documentation and bureaucratic procedures. However, significant reforms are underway to address these obstacles. Iraq is actively implementing automation, pre-customs declarations, and a unified customs tariff, aiming to streamline operations and standardize procedures across all border points [AHK Iraq / Iraqi Embassy Berlin (2025)]. Therefore, understanding these changes is crucial for efficient shipping to Iraq.

A key development is the mandatory Pre-Customs Declaration for financial transfers and customs clearance, effective from 1 December 2025 [AHK Iraq / Iraqi Embassy Berlin (2025)]. Additionally, the Ministry of Finance is enforcing a new unified customs tariff at all borders from 1 July 2025. This requires all bills of lading and manifests to carry valid 6-digit HS codes, with penalties for non-compliance [Ocean Network Express (2025)]. These measures are designed to reduce manual checks and “back-and-forth” paperwork, ultimately improving the customs clearance process in Iraq.

The pressure to modernize stems from rapid growth. Iraq’s seaports, for instance, handled an impressive 22.4 million tons of cargo and 1,522 ships in H1 2025 [AHK Iraq (2025)]. Moreover, customs revenue reached USD 1.68 billion in 2025 [Iraqi News (2025)], a marked increase attributed to automation and better duty collection. Therefore, adapting to these digital and regulatory shifts is paramount for businesses.

Adapting to Evolving Regulations and Digitalization for Faster Clearance

Adapting to the evolving import regulations Iraq is introducing is essential for a smooth customs clearance process in Iraq. The unified customs tariff, alongside mandatory HS codes, necessitates meticulous preparation. However, these changes promise to bring Iraq’s average clearance times closer to GCC benchmarks, typically 1–3 days for compliant shipments. This predictability is vital for businesses engaging in shipping to Iraq, including those utilizing Customs Clearance Kurdistan gateways like Ibrahim Khalil and Erbil International Airport.

The sheer volume of trade further underscores the need for modernization. Iraq’s merchandise imports hover around USD 60–70 billion annually [World Bank / UN Comtrade, inferred], a growing figure that makes faster, more predictable clearance a critical competitiveness issue. Therefore, companies must ensure their documentation is precise and compliant with the latest requirements. Engaging a reliable customs brokerage Erbil or Baghdad-based can significantly mitigate risks.

Furthermore, the rise of e-commerce and express shipments is setting new expectations for the customs clearance process in Iraq. Customers now anticipate 2–5 day end-to-end delivery. This pushes customs authorities to simplify procedures and embrace digital tools. Therefore, leveraging digital customs tools and pre-declaration processes is no longer optional but a necessity for timely delivery.

Leveraging Expert Partnerships for Streamlined Customs Clearance

Overcoming challenges in the customs clearance process in Iraq requires a proactive approach and often, expert partnership. Businesses must stay updated on the latest import regulations Iraq implements, such as the mandatory Pre-Customs Declaration from December 2025 and the unified customs tariff effective July 2025. However, the complexity of these regulations can be daunting.

Partnering with an experienced logistics provider like Direct Drive Logistics, specializing in Iraq and Kurdistan, offers a distinct advantage. We provide expert customs brokerage Erbil and across Iraq, ensuring compliance with the 6-digit HS code requirement and navigating bureaucratic hurdles efficiently. Therefore, our expertise helps businesses avoid penalties and delays, ensuring predictable shipping to Iraq. This strategic partnership is key to transforming potential obstacles into opportunities for smoother, faster trade.

Best Practices for Efficient and Compliant Customs Clearance in Iraq

Meticulous Preparation of Accurate and Complete Documentation for Smooth Processing

Optimizing the customs clearance process in Iraq begins with impeccable documentation. The Iraqi government is actively modernizing, aiming to shorten clearance times and standardize procedures. Therefore, strict adherence to new requirements is paramount. From 1 December 2025, a Pre‑Customs Declaration will be mandatory for financial transfers and customs clearance [AHK Iraq]. This crucial step is designed to cut delays and support automation at border crossings.

Additionally, a new unified customs tariff will be enforced at all borders from 1 July 2025 by the Ministry of Finance [Ocean Network Express]. Consequently, all bills of lading and manifests must accurately carry valid **6‑digit HS codes**. Non‑compliance can result in significant penalties and protracted delays. Accurate documentation directly reduces manual checks and “back‑and‑forth” paperwork, especially at key points like Umm Qasr.

Partnering with Experienced Local Customs Brokers for Navigating Iraqi Regulations

Navigating the complex customs clearance process in Iraq demands local expertise. Iraq’s growing economy and trade volumes underscore the need for efficient logistics. For instance, Iraq’s seaports handled a remarkable **22.4 million tons of cargo and 1,522 ships in H1 2025** [AHK Iraq]. Furthermore, the nation’s merchandise imports are estimated at around **USD 60–70 billion annually**, highlighting the scale of operations.

Partnering with an experienced local customs brokerage in Erbil or Baghdad is therefore critical. These experts possess deep knowledge of specific import regulations Iraq enforces, including nuances for shipping to Iraq via KRI gateways. They can proactively address potential issues, ensuring compliance and significantly streamlining the customs clearance process in Iraq. This partnership helps mitigate risks and avoids costly demurrage or storage fees.

Proactive Monitoring of Evolving Iraqi Customs Regulations and Tariff Changes

Staying ahead of regulatory changes is essential for an efficient customs clearance process in Iraq. The rapid growth in customs revenue, which reached **USD 1.68 billion in 2025** [Iraqi News], indicates a strong push for modernization and tighter compliance. Therefore, keeping abreast of evolving import regulations Iraq introduces is not merely good practice but a necessity.

The global shift towards digital documentation and e-commerce also impacts expectations for the customs clearance process in Iraq. Clients now expect **2–5 day end‑to‑end delivery**, pushing authorities to simplify procedures. Additionally, continuous monitoring of tariff updates and procedural reforms ensures that your shipments always meet the latest requirements. This proactive approach is key to successfully manage the customs clearance process in Iraq, fostering trust and operational efficiency.

Frequently Asked Questions

▼ What exactly is the customs clearance process in Iraq for imported goods?

The customs clearance process in Iraq involves inspecting, documenting, and taxing imported goods to ensure compliance with Iraqi trade laws. It's crucial for legal entry and includes submitting declarations, obtaining permits, and paying duties. Direct Drive Logistics streamlines this, ensuring your cargo moves efficiently through ports like Umm Qasr or border crossings.

▼ How long does the customs clearance process in Iraq typically take for commercial shipments?

Generally, the customs clearance process in Iraq can take 3-7 business days, depending on cargo type, documentation accuracy, and specific border/port congestion. Complex shipments or those requiring special permits might take longer. We leverage our 15+ years of regional experience to expedite your shipments, providing real-time updates.

▼ What essential documents are required for smooth customs clearance in Iraq?

Key documents include the Commercial Invoice, Packing List, Bill of Lading/Air Waybill, Certificate of Origin, and any necessary import licenses or permits. Accurate and complete documentation is paramount to avoid delays in the customs clearance process in Iraq. Direct Drive Logistics assists clients in preparing and verifying all required paperwork.

▼ How much do customs duties and taxes typically add to shipping costs in Iraq?

Customs duties and taxes in Iraq vary significantly based on the HS code, origin, and value of goods. Rates can range from 0% for essential items to over 30% for others, plus a 5% reconstruction tax. Direct Drive Logistics provides detailed cost estimates upfront, ensuring transparency and no hidden fees for your logistics in Iraq.

▼ Why choose Direct Drive Logistics to manage the customs clearance process in Iraq?

With 15+ years of dedicated regional expertise, Direct Drive Logistics offers unparalleled insights into the nuances of the customs clearance process in Iraq. We navigate complex regulations, minimize delays, and ensure compliance. Our proactive approach and strong relationships with customs officials guarantee efficient, reliable, and cost-effective solutions for your supply chain.

▼ How does customs clearance differ between Federal Iraq and the Kurdistan Region (KRG)?

While both adhere to federal customs law, practical implementation and documentation nuances can differ. The KRG often has streamlined procedures at its borders (e.g., Ibrahim Khalil, Bashmakh). Direct Drive Logistics possesses dual expertise, ensuring seamless customs clearance whether your cargo is destined for Baghdad or Erbil, adapting to regional specifics.

▼ What is the role of HS codes in streamlining the customs clearance process in Iraq?

Harmonized System (HS) codes are crucial for classifying goods, determining applicable duties, and ensuring regulatory compliance. Incorrect HS codes are a major cause of delays in the customs clearance process in Iraq. Direct Drive Logistics meticulously verifies HS codes to prevent misclassification, speeding up your shipments and avoiding penalties.

▼ How can businesses avoid common delays during the customs clearance process in Iraq?

To avoid delays, ensure all documentation is accurate, complete, and submitted promptly. Pre-clearance arrangements and thorough preparation are key. Partnering with an experienced logistics provider, with deep knowledge of local regulations and customs procedures, is the most effective strategy for efficient cargo movement in Iraq.

▼ What types of goods are prohibited or restricted from import into Iraq?

Iraq prohibits the import of items like narcotics, certain chemicals, pornography, and goods from specific embargoed countries. Restricted items, such as pharmaceuticals, firearms, and some agricultural products, require special permits. Direct Drive Logistics provides up-to-date guidance on prohibited and restricted goods, ensuring compliance for your shipments.

▼ What is a customs broker, and why is one essential for logistics in Iraq?

A customs broker is a licensed expert who facilitates the customs clearance process, handling documentation, duty calculations, and liaising with customs authorities. Given Iraq's complex regulatory environment, an experienced broker like Direct Drive Logistics is essential to navigate procedures, minimize risks, and ensure timely, compliant cargo delivery.

▼ How does Direct Drive Logistics ensure compliance with evolving Iraqi customs regulations?

Our dedicated team constantly monitors updates from the Iraqi Customs Authority and KRG customs bodies. We maintain strong relationships with officials and participate in industry forums. This proactive approach ensures our clients' shipments always comply with the latest regulations, mitigating risks and ensuring smooth operations in Iraq.

▼ What specific challenges does Direct Drive Logistics help overcome in the customs clearance process in Iraq?

We overcome challenges like inconsistent documentation requirements, varying interpretations of regulations, and potential delays at congested borders. Our 15+ years of experience allows us to anticipate issues, proactively communicate with authorities, and resolve complexities swiftly, ensuring a predictable and efficient customs clearance process in Iraq for your valuable cargo.

Conclusion

Navigating the customs clearance process in Iraq is undeniably complex, demanding precision, up-to-date knowledge of regulations, and proactive management. As we've explored, overlooking even minor details can lead to significant delays, increased costs, and operational disruptions. For businesses aiming to import or export efficiently within Iraq, understanding these intricacies is paramount, but executing them flawlessly requires more than just awareness – it demands expert partnership.

This is precisely where Direct Drive Logistics excels. We don't just understand the customs clearance process in Iraq; we master it. Our dedicated team, armed with extensive local expertise and a proactive approach, meticulously handles all documentation, tariffs, and regulatory compliance on your behalf. By entrusting your customs needs to us, you gain more than just a service provider; you gain a strategic partner committed to streamlining your supply chain, minimizing risks, and ensuring your goods move swiftly and compliantly across Iraqi borders. We transform potential hurdles into seamless transitions, saving you invaluable time, resources, and peace of mind.

Don't let the complexities of customs clearance impede your business growth in Iraq. Partner with Direct Drive Logistics for unparalleled efficiency and reliability. Experience the difference that true expertise makes in accelerating your operations and achieving your logistical goals. Reach out to our team today for a personalized consultation and discover how we can simplify your import and export journey.

Navigate the complexities of Iraqi customs with unparalleled ease and speed.

📞 Contact Us for a Consultation

Location

Direct Drive Logistic

MRF Quattro towers, Block A-29-1

Erbil, Kurdistan Region