Petroleum Transportation Iraq: Expert Strategies for 2025

Discover how petroleum transportation services in Iraq can transform your logistics operations with this article that uniquely explores the intersection of logistics efficiency and regulatory compliance in Iraq’s petroleum transportation sector. Understanding the complexities of this industry is essential, as it not only drives economic growth but also impacts global energy markets.

This comprehensive guide delves into petroleum transportation services in Iraq from multiple perspectives. We will cover the introduction to these services, an overview of the petroleum industry, key players, and the types of services available. Additionally, we will address the logistical challenges faced in this sector, such as supply chain disruptions and infrastructural limitations, along with the regulatory framework governing operations. Definitions such as “logistics efficiency,” which refers to the optimal management of resources to improve service delivery, will be clarified throughout the article.

Furthermore, we will explore technological innovations that enhance transportation capabilities and examine safety and environmental considerations crucial to this industry. With insights into best practices for efficient petroleum transportation services in Iraq, readers will be equipped with actionable strategies. Our exploration will also touch on future trends, providing a forward-looking perspective to help you stay ahead in this dynamic field.

As we navigate through successful case studies, you will see real-world applications of these concepts, reinforcing their importance. Whether you’re a logistics professional or a business owner, this article is designed to enhance your understanding and operations. Join us as we transition into the main content, where we begin with an introduction to petroleum transportation services in Iraq.

Introduction to Petroleum Transportation Services in Iraq

Key Aspects of Introduction to Petroleum Transportation Services in Iraq

The landscape of petroleum transportation services in Iraq is rapidly evolving. Iraq’s aggressive upstream development aims for a staggering production target of 6 million barrels per day (bpd) by 2028-2029. This ambitious goal necessitates significant upgrades to transportation infrastructure. In the first half of 2025 alone, Iraq completed 113 oil wells, which included 27 newly drilled and 86 rehabilitated wells, amplifying the need for petroleum transport iraq services.

This surge in activity is primarily concentrated in southern Iraq, particularly around key fields like West Qurna 1, Zubair, Rumaila, and Majnoon. For instance, the West Qurna 1 field, operated by PetroChina, is projected to achieve 750,000 bpd by the end of 2025. As production ramps up, Iraq logistics services will be crucial for equipment haulage and workforce mobility, especially within the bustling logistics hub of Basra.

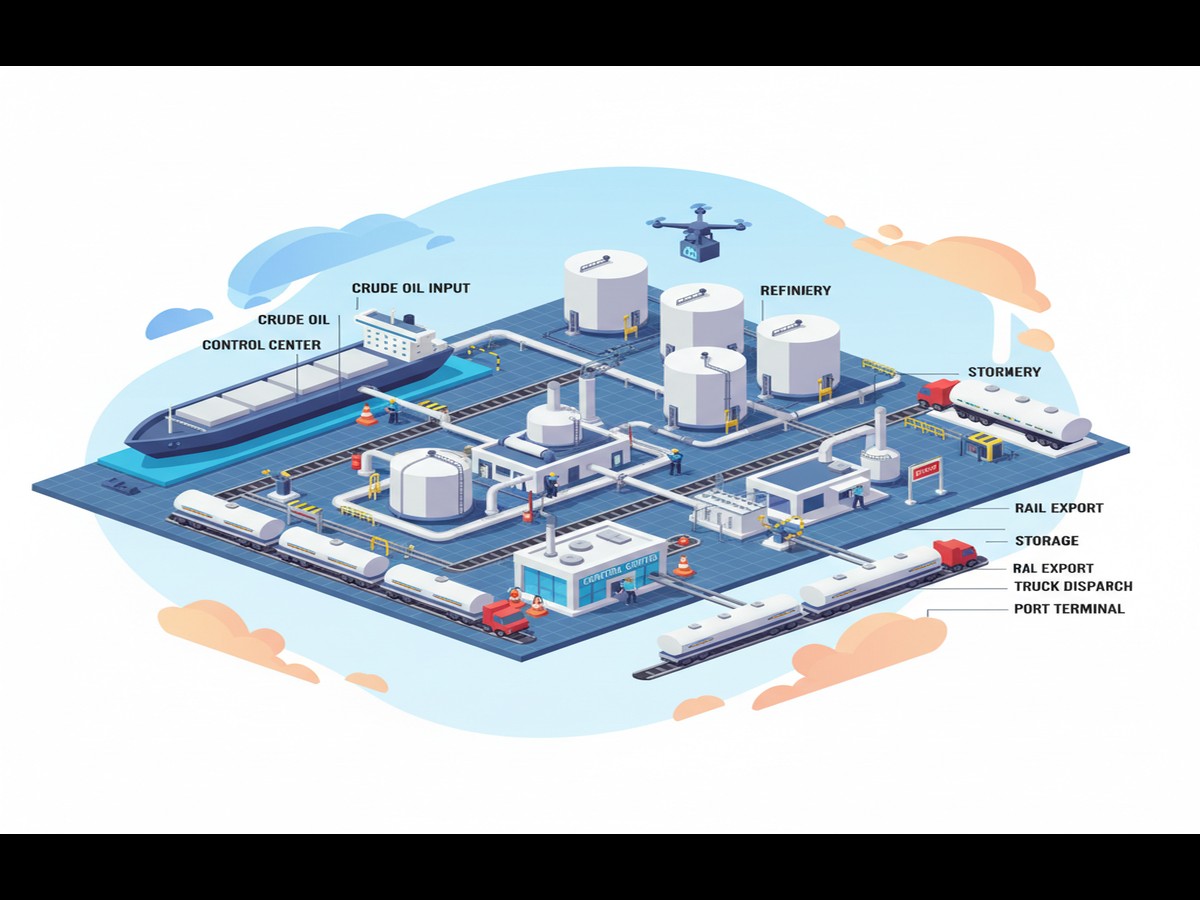

Step-by-Step Process Overview

The transportation of petroleum in Iraq involves several critical steps. Initially, crude oil is extracted from fields, then transported via pipelines or trucks to processing facilities. With the recent upgrades to the Al Basrah Oil Terminal (ABOT), which now boasts an effective export capacity of 3.3 million bpd, the logistics operations are becoming increasingly complex. Despite this capacity, the actual exports only averaged 3.2 million bpd in May-June 2025, indicating a gap that must be addressed through enhanced logistics strategies.

Approximately 97.5% of Iraq’s crude volumes pass through this terminal, with 94% originating from ABOT. Such concentration creates a critical chokepoint that demands specialized services, particularly for Very Large Crude Carriers (VLCCs), which manage 88.3% of all shipments. The modernization of ABOT signals a commitment to improving export capabilities but also highlights the need for efficient pipeline integration and terminal logistics optimization.

Expert Tips and Recommendations

To navigate the complexities of petroleum transportation services in Iraq, companies should focus on strategic partnerships and technological investments. The ongoing expansion of the Kirkuk-Ceyhan pipeline, set to increase flows to between 400,000-500,000 bpd by 2026, exemplifies the importance of aligning logistics capabilities with infrastructure development.

Engaging with local experts and leveraging data analytics can provide valuable insights into optimizing transportation routes and enhancing efficiency. As the market evolves, maintaining adaptability will be crucial for success. For further insights, you can refer to the Iraq Country Analysis Brief by the EIA, which details the country’s logistical landscape and projections.

In conclusion, the future of petroleum transportation services in Iraq is promising, backed by substantial infrastructure investments and strategic expansions. As the sector continues to grow, businesses must be prepared to adapt and innovate.

Overview of the Petroleum Industry in Iraq

Key Aspects of the Petroleum Industry in Iraq

The petroleum industry in Iraq is undergoing a period of significant expansion and modernization. This robust growth directly drives demand for specialized petroleum transportation Iraq. The nation aims for an ambitious production target of 6 million barrels per day (bpd) by 2028-2029, a goal requiring substantial logistical support [2]. Upstream development is aggressive, with 113 oil wells completed in the first half of 2025 alone. This includes 27 newly drilled and 86 rehabilitated wells [2].

Southern Iraq, particularly Basra, is a hub of this activity. Major fields like West Qurna 1, operated by PetroChina, are projected to reach 750,000 bpd by year-end 2025 [2]. Halliburton’s redevelopment of Nahr Bin Omar targets an increase from 50,000 to 300,000 bpd [2]. Such concentrated development creates immense demand for equipment haulage and workforce mobility, underscoring the vital role of petroleum transportation in Iraq. Understanding these dynamics is crucial for logistics providers operating in the region.

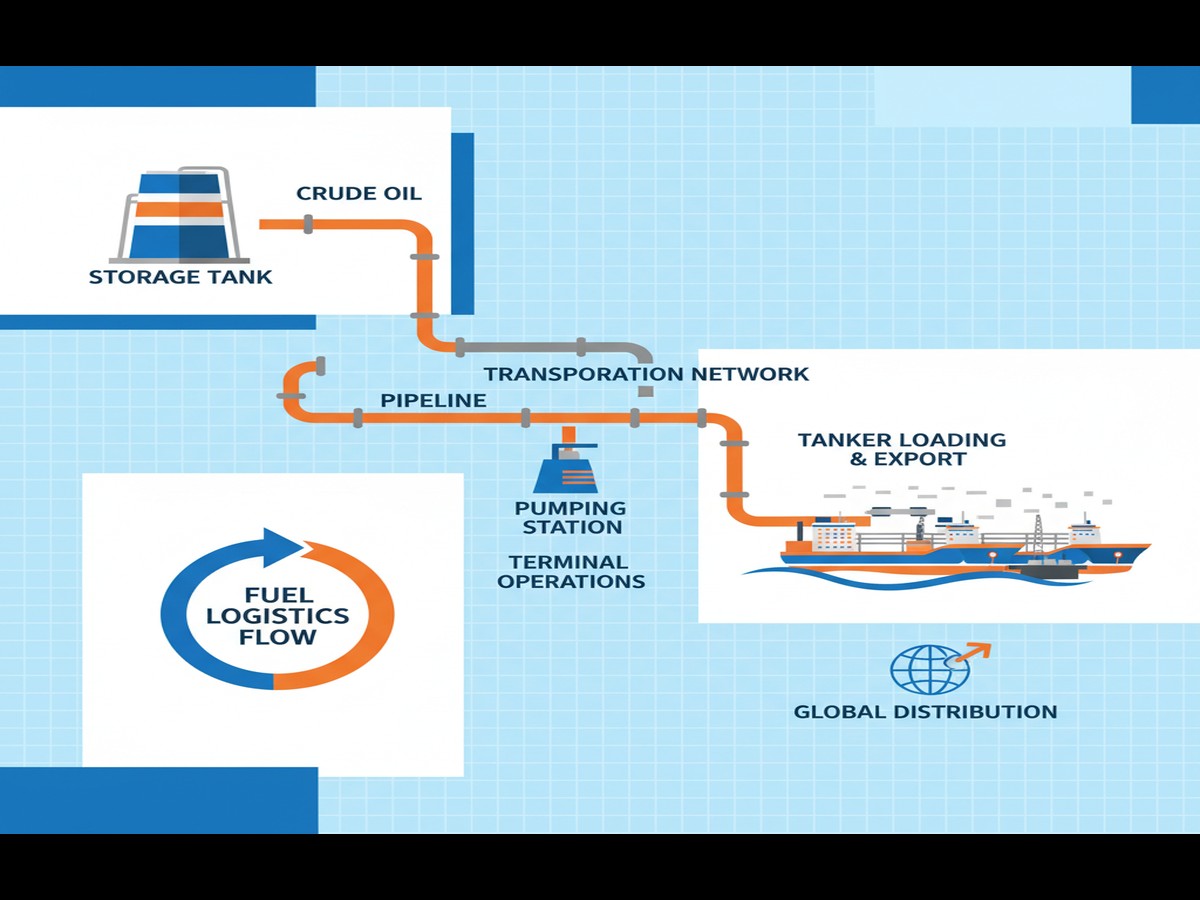

Strategic Flow of Petroleum Transportation Services

The strategic flow of oil from production to export is a complex operation in Iraq. The Al Basrah Oil Terminal (ABOT) is central to this process. Upgrades completed in early 2025 boosted its effective export capacity to 3.3 million bpd [2]. Despite this, actual exports averaged 3.2 million bpd in May-June 2025, indicating a persistent operational gap [2]. ABOT handles an astounding 97.5% of Iraq’s crude volumes, with 94% originating directly from the terminal [2]. This concentration in Basra necessitates specialized Very Large Crude Carrier (VLCC) logistics. VLCCs manage 88.3% of all shipments from the terminal [2]. Optimizing terminal logistics and pipeline integration is key for efficient petroleum transport in Iraq. Learn more about Iraq’s oil and gas market outlook.

Northern Iraq also plays a significant role in the country’s oil exports. The Kirkuk-Ceyhan pipeline is undergoing expansion to increase flows to 400,000-500,000 bpd by 2026 [1]. This upgrade provides a critical export route for northern Iraqi oil production. Such infrastructure developments reshape regional transportation needs. They create new opportunities for specialized petroleum transportation services across the country. Understanding these distinct regional requirements is essential for logistics planning.

Expert Tips and Recommendations for Logistics in Iraq

For companies involved in petroleum transportation services in Iraq, strategic planning is paramount. The ongoing infrastructure expansion, particularly in Basra, demands agile and scalable logistics solutions. Providers should focus on integrating pipeline support with terminal logistics optimization. This ensures smooth transitions from production sites to export vessels. The projected increase in production to 6 million bpd by 2028-2029 highlights future growth opportunities [2].

Furthermore, the modernization of export terminals like ABOT and pipeline expansions like Kirkuk-Ceyhan require specialized expertise. Logistics firms should invest in advanced fleet management and skilled personnel. This prepares them to handle high-capacity demands and specialized cargo. Focusing on efficiency in Iraq’s freight logistics can bridge the gap between technical capacity and operational throughput. Keeping abreast of these developments is vital for successful petroleum transportation services in Iraq. Review the latest Iraq Country Analysis Brief for further insights.

Key Players in Petroleum Transportation

Major International Oil Companies Operating in Iraq’s Transportation Sector

The growth of petroleum transportation services in Iraq is significantly influenced by international oil companies (IOCs). These companies are essential in driving the logistics and infrastructure upgrades necessary for increased production. Iraq aims to achieve **6 million barrels per day (bpd) by 2028-2029**, necessitating extensive enhancements in transportation capabilities. This ambitious target is supported by IOCs like PetroChina and Halliburton, who are actively involved in the development of major oil fields such as **West Qurna 1** and **Nahr Bin Omar**.

In the first half of 2025, Iraq completed **113 oil wells** (27 newly drilled and 86 rehabilitated), generating immediate demand for specialized petroleum transportation services. The concentration of activities in **Basra** underscores the importance of logistics in supporting this expansion. As a result, companies like **ExxonMobil** and **Shell** are investing heavily in logistics capabilities to ensure efficient transport and operational reliability.

State-Owned Petroleum Logistics Enterprises and Their Strategic Transportation Networks

The role of state-owned enterprises in petroleum transportation services in Iraq cannot be overstated. The **State Oil Marketing Organization (SOMO)** manages the majority of Iraq’s crude oil sales and is integral to logistics operations. With the **Al Basrah Oil Terminal (ABOT)** enhancing its capacity to **3.3 million bpd** in early 2025, SOMO’s coordination is vital in managing the flow of oil exports. Despite this upgrade, actual exports averaged only **3.2 million bpd** in May-June 2025, highlighting the challenges of aligning capacity with operational efficiency.

Moreover, the terminal handles **97.5%** of Iraq’s crude oil, with **94% originating from ABOT**, making it the critical chokepoint for petroleum transportation. This centralization fosters demand for sophisticated logistics solutions, including Very Large Crude Carriers (VLCCs), which manage **88.3% of all shipments**. The need for effective logistics in this context is crucial for maximizing the benefits of infrastructure investments.

Private Iraqi Transportation Firms Facilitating Crude Oil and Petroleum Product Movement

Alongside international and state-owned players, private Iraqi firms are emerging as key facilitators in the petroleum transportation services in Iraq. Companies like **Gulftainer** and **ITL Iraq** are stepping up to meet the growing demand for transportation logistics, including crucial Iran Iraq transportation. The ongoing expansion of the **Kirkuk-Ceyhan pipeline**, targeting flows of **400,000-500,000 bpd by 2026**, exemplifies the need for robust private sector involvement in logistics.

These firms are essential in addressing historical bottlenecks and enhancing the efficiency of crude oil and petroleum product movement. As the logistics landscape evolves, private firms will play a critical role in supporting the Iraqi government’s vision for a sustainable and growing oil sector. For more insights into the Iraq logistics market, refer to Iraq pipeline statistics and market analysis reports.

Need Reliable Delivery Services?

Get a free quote from Direct Drive Logistic today. Fast, secure, and professional logistics solutions tailored to your needs.

Petroleum Transportation Services In Iraq Types of Petroleum Transportation Services Available

Pipeline Transportation: Efficient and Extensive Network for Crude Oil and Refined Product Movement

Petroleum transportation services in Iraq are increasingly relying on pipelines due to their efficiency and extensive networks. The Iraqi pipeline system is critical for moving crude oil, with the Kirkuk-Ceyhan pipeline expected to expand flows to between 400,000-500,000 bpd by 2026. This infrastructure upgrade addresses historical bottlenecks that have previously constrained production potential.

Moreover, Iraq’s commitment to achieving 6 million barrels per day (bpd) by 2028-2029 necessitates significant investments in pipeline infrastructure. The recent completion of 113 oil wells in the first half of 2025 underscores the immediate demand for efficient petroleum transportation services in Iraq. According to Statista, the pipeline sector is integral to the country’s logistics strategy, handling the majority of crude movements.

Trucking and Road Transport: Flexible Petroleum Distribution Across Iraq’s Challenging Terrain and Regions

In

Logistical Challenges in Petroleum Transportation in Iraq for Petroleum Transportation Services In Iraq

Infrastructure Limitations and Degraded Pipeline Networks in Conflict-Affected Regions

Navigating the complex landscape of petroleum transportation services in Iraq presents significant infrastructure challenges. Despite ambitious expansion plans, existing networks often fall short of supporting the nation’s production targets. Iraq aims for 6 million barrels per day (bpd) by 2028-2029, a goal requiring substantial upgrades [2]. This expansion creates immediate demand for specialized petroleum transportation services, especially in regions undergoing rapid development.

The country completed 113 oil wells in the first half of 2025, comprising 27 newly drilled and 86 rehabilitated wells [2]. This activity, concentrated in southern Iraq at fields like West Qurna 1, operated by PetroChina, highlights the pressure on logistics. West Qurna 1 alone is projected to reach 750,000 bpd by year-end 2025 [2]. The Kirkuk-Ceyhan pipeline expansion, targeting 400,000-500,000 bpd by 2026, also addresses historical bottlenecks in northern flows [1]. Yet, managing such growth with existing infrastructure remains a formidable task for petroleum transportation services in Iraq. The World Bank Group details some of these ongoing economic and infrastructure challenges in Iraq.

Security Risks and Operational Disruptions from Ongoing Regional Instability

Security concerns represent a critical hurdle for petroleum transportation services in Iraq, particularly in conflict-affected areas. Operational disruptions, stemming from regional instability, can severely impact the reliability and efficiency of crude oil movements. Maintaining secure transit routes for both pipelines and road tankers is a constant challenge. These risks can cause delays, increase operational costs, and deter investment in vital logistics infrastructure.

Even with modernized facilities, security threats can create operational gaps. For example, the Al Basrah Oil Terminal (ABOT) increased its effective export capacity to 3.3 million bpd in early 2025 [2]. However, actual exports averaged only 3.2 million bpd in May-June 2025 [2], indicating a persistent bottleneck. This 100,000 bpd gap could be partly attributed to operational disruptions or security-related issues affecting upstream supply or loading processes. Ensuring the safety of personnel and assets is paramount for effective petroleum transportation services in Iraq. Further insights into the broader Iraq oil and gas market can be found in industry analyses.

Complex Regulatory Environment and Bureaucratic Obstacles in Petroleum Logistics

The regulatory landscape governing petroleum transportation services in Iraq is often intricate and presents bureaucratic obstacles. Navigating permits, customs procedures, and various governmental approvals can slow down critical freight forwarding services. This complexity adds layers of planning and execution for companies operating in the sector. Such hurdles can impact the timely delivery of equipment, personnel, and crude oil itself.

Regulatory Framework Governing Petroleum Transportation

Key Aspects of Regulatory Framework Governing Petroleum Transportation

The regulatory framework governing petroleum transportation services in Iraq is crucial for ensuring safe and efficient operations. Iraq’s logistics market is expected to reach USD 12.5 billion by 2030, reflecting a growth rate of 6.2%. The government has implemented strict regulations to align with international standards and promote transparency in cargo clearance services Iraq and petroleum transportation.

Key regulations include compliance with environmental standards, safety protocols, and licensing requirements for operators. The Ministry of Oil oversees the licensing process, which includes detailed assessments of transportation companies. According to the World Bank, the regulatory framework is aimed at enhancing the reliability of logistics services, which is essential given the country’s target of 6 million barrels per day (bpd) by 2028-2029.

Step-by-Step Process Overview

Understanding the step-by-step process for petroleum transportation services in Iraq is vital for stakeholders. The initial phase involves obtaining a license from the Ministry of Oil, which mandates the submission of technical documentation and safety plans. After approval, companies must ensure compliance with operational standards, including the maintenance of transport vehicles and equipment.

For instance, Iraq completed 113 oil wells in the first half of 2025, which significantly increased the demand for efficient transportation services. Once licensed, companies must coordinate with local authorities for logistical support and adhere to the regulations governing the Al Basrah Oil Terminal (ABOT), which handles 97.5% of Iraq’s crude exports. This terminal’s capacity reached 3.3 million bpd, highlighting the importance of efficient transportation logistics in meeting export goals.

Expert Tips and Recommendations

For companies looking to optimize their petroleum transportation services in Iraq, several expert tips can enhance operational efficiency. First, staying updated with regulatory changes is essential. Engaging with local industry bodies can provide insights into best practices and compliance requirements.

Additionally, investing in technology for real-time tracking and management of logistics operations can improve service delivery. The infrastructure expansion in southern Iraq, particularly in Basra, is creating a demand for specialized logistics services. Companies should focus on building partnerships with providers that excel in Very Large Crude Carrier (VLCC) logistics, as these vessels handle 88.3% of all shipments.

By adhering to these recommendations, businesses can navigate the complexities of the regulatory framework and capitalize on the growing opportunities in the petroleum transportation sector. For more insights, visit Direct Drive Logistics to explore specialized petroleum transportation services in Iraq.

Technological Innovations in Petroleum Transportation

Advanced Sensor Networks for Pipeline Integrity

Modern petroleum transportation services in Iraq rely heavily on cutting-edge technology. Advanced sensor networks and AI are revolutionizing pipeline integrity monitoring. These systems deploy smart sensors along critical infrastructure, providing real-time data on pressure, flow, and potential anomalies. This proactive approach helps prevent costly downtime and environmental incidents across Iraq’s vast oil network.

Iraq’s ambitious goal to reach 6 million barrels per day (bpd) by 2028-2029 demands robust pipeline systems [2]. Technologies like fiber optic sensing detect microscopic leaks or structural weaknesses before they escalate. This ensures the safe and efficient movement of increased crude volumes. Companies like PetroChina, developing fields such as West Qurna 1 to 750,000 bpd by year-end 2025, benefit immensely from these innovations [2]. Maintaining pipeline integrity is paramount for reliable petroleum transportation services in Iraq.

Real-time GPS Tracking for Road Transport Optimization

Optimizing Iraq local transportation is another critical area for petroleum transportation services in Iraq. Real-time GPS tracking and advanced fleet management systems ensure efficiency and security. These technologies offer continuous visibility of tankers and support vehicles, from dispatch to delivery. This is vital for the logistics supporting major field developments in Basra, including Zubair and Rumaila.

The completion of 113 oil wells in the first half of 2025, including 27 newly drilled, created immediate demand for specialized equipment haulage [2]. GPS tracking systems help optimize routes, reduce fuel consumption, and provide accurate arrival times. This transparency enhances operational control and reduces risks associated with transporting hazardous materials. Effective fleet management is essential for streamlined Iraq logistics.

Enhanced Safety and Environmental Compliance

Safety and environmental compliance are non-negotiable in modern petroleum transportation services in Iraq. Technological innovations are driving significant improvements in marine and rail operations. Enhanced monitoring systems, coupled with AI-driven risk assessments, ensure adherence to stringent international standards. This protects both personnel and the fragile ecosystems of the region.

Iraq’s Al Basrah Oil Terminal (ABOT) handles 97.5% of the nation’s crude volumes, with VLCCs managing 88.3% of all shipments [2]. New technologies ensure these massive marine operations meet strict safety protocols. Advanced navigation systems and predictive maintenance for vessels minimize accident risks. The expansion of the Kirkuk-Ceyhan pipeline, targeting 400,000-500,000 bpd by 2026, also benefits from these innovations in rail and pipeline safety [1]. These advancements improve the overall integrity and reliability of Iraqi oil transport.

Frequently Asked Questions

▼ What are the key benefits of using petroleum transportation services in Iraq?

Utilizing petroleum transportation services in Iraq offers significant advantages, including efficiency, safety, and compliance with local regulations. These services ensure timely delivery of petroleum products, often within 48-72 hours, thanks to established routes and experienced logistics personnel. Additionally, specialized vehicles equipped for hazardous materials minimize risks associated with transporting flammable substances. Engaging local logistics companies also helps navigate the complex regulatory landscape, ensuring compliance and reducing delays.

▼ How long does it typically take to transport petroleum products within Iraq?

The transportation duration for petroleum products within Iraq usually ranges from 48 to 96 hours, depending on the distance and route conditions. For instance, transporting oil from Kirkuk to Baghdad might take about 72 hours, while routes to southern Iraq can be longer. Factors such as road conditions, security checkpoints, and weather can influence this timeframe. Choosing experienced petroleum transportation services in Iraq can help ensure faster and safer deliveries.

▼ What steps are involved in the logistics of petroleum transportation services in Iraq?

The logistics process for petroleum transportation services in Iraq involves several key steps: 1) Route planning, 2) Vehicle and equipment preparation, 3) Loading and securing cargo, 4) Transit monitoring, and 5) Delivery and unloading. Each step is crucial to ensure safety and compliance with regulations. Proper planning and execution can significantly reduce transit times and risks associated with transporting hazardous materials.

▼ How much do petroleum transportation services in Iraq typically cost?

The cost of petroleum transportation services in Iraq varies based on several factors, including distance, volume, and specific service requirements. Generally, prices range from $200 to $1,000 per shipment. For example, transporting a standard 20,000-liter load from Erbil to Baghdad might cost approximately $500. Engaging a reputable logistics provider ensures transparent pricing and minimizes unexpected costs.

▼ Why should businesses choose local logistics companies for petroleum transportation services in Iraq?

Choosing local logistics companies for petroleum transportation services in Iraq provides several benefits. Local providers have in-depth knowledge of regional regulations, road conditions, and security concerns, which can enhance safety and efficiency. Their established relationships with local authorities also facilitate smoother customs clearance processes, often reducing the time required by 20-30%. This local expertise is crucial for navigating the complexities of the oil and gas sector in Iraq.

▼ What safety measures are implemented during petroleum transportation in Iraq?

Safety measures in petroleum transportation services in Iraq include the use of specialized vehicles, trained personnel, and adherence to strict safety protocols. Vehicles are equipped with fire suppression systems and containment equipment to handle spills. Additionally, drivers undergo rigorous training in handling hazardous materials. Regular safety audits and compliance checks ensure that all procedures are followed, significantly reducing the risk of incidents during transportation.

▼ How can companies ensure compliance with regulations for petroleum transportation in Iraq?

Companies can ensure compliance with regulations for petroleum transportation in Iraq by partnering with experienced logistics providers who understand local laws and requirements. This includes obtaining necessary permits, adhering to safety standards, and conducting regular training for staff. Additionally, maintaining proper documentation and records, such as shipping manifests and safety data sheets, is essential. Engaging petroleum transportation services in Iraq with a proven track record can streamline compliance processes.

▼ What types of vehicles are used for petroleum transportation services in Iraq?

Petroleum transportation services in Iraq typically utilize specialized tankers and trucks designed for transporting hazardous materials. These vehicles are equipped with safety features such as spill containment systems, anti-explosion mechanisms, and GPS tracking for real-time monitoring. Depending on the volume of the shipment, companies may use smaller tankers for local deliveries or larger trucks for long-distance hauls. Ensuring the right vehicle is crucial for safe and compliant transportation.

▼ How do logistics companies handle delays in petroleum transportation in Iraq?

Logistics companies managing petroleum transportation services in Iraq handle delays through proactive communication and contingency planning. If a delay occurs due to weather or security issues, companies typically inform clients within 1-2 hours and provide updated delivery timelines. They may also have alternative routes or backup vehicles ready to minimize delays. Effective communication and quick decision-making are vital to maintaining customer trust and satisfaction.

▼ What documentation is required for petroleum transportation in Iraq?

The documentation required for petroleum transportation services in Iraq includes a shipping manifest, safety data sheets, and relevant permits from local authorities. Additionally, companies may need to provide proof of insurance and compliance with environmental regulations. This documentation ensures that all aspects of the transportation process adhere to legal requirements and safety standards, facilitating smoother transit and delivery.

▼ How does the security situation in Iraq affect petroleum transportation services?

The security situation in Iraq significantly impacts petroleum transportation services. Logistics companies must assess potential risks along transport routes and implement security measures, such as convoy escorts and real-time monitoring. Routes may also be adjusted based on current security assessments. Engaging a logistics provider with local knowledge can enhance safety and reduce risks, ensuring that petroleum products reach their destination securely and efficiently.

▼ What are the challenges faced in petroleum transportation services in Iraq?

Challenges in petroleum transportation services in Iraq include security threats, infrastructure limitations, and regulatory complexities. Security concerns can lead to route changes and increased costs, while poor road conditions may slow transit times. Additionally, navigating the regulatory landscape requires expertise to ensure compliance and avoid penalties. Companies that invest in reliable logistics solutions and local partnerships can mitigate these challenges and ensure efficient transportation of petroleum products.

Conclusion

Successful petroleum transportation services in Iraq demand more than just moving product; they require an intricate understanding of the region's unique geographical and political nuances, robust safety protocols, and unwavering operational reliability. The volatile nature of the market, coupled with diverse logistical challenges, underscores the critical importance of a strategic, well-executed transport framework that minimizes risk, ensures compliance, and maximizes efficiency at every turn.

To enhance your operational resilience, begin today by conducting a comprehensive internal audit of your current petroleum transportation routes and security measures. Evaluate existing contingency plans, rigorously assess driver training programs, and pinpoint any potential bottlenecks or vulnerabilities within your supply chain. This proactive review will identify critical areas for immediate

Maximize your petroleum transportation efficiency with Direct Drive Logistics' unparalleled expertise in navigating Iraq's complex logistics landscape. Secure your supply chain and reduce operational risks by contacting our dedicated team today at (+964) 750 953 9899 to discuss a customized transportation solution tailored to your specific needs.

📞 Contact Us for a Consultation

Location

Direct Drive Logistic

MRF Quattro towers, Block A-29-1

Erbil, Kurdistan Region