Mastering Customs Clearance: Your Essential 2025 Guide

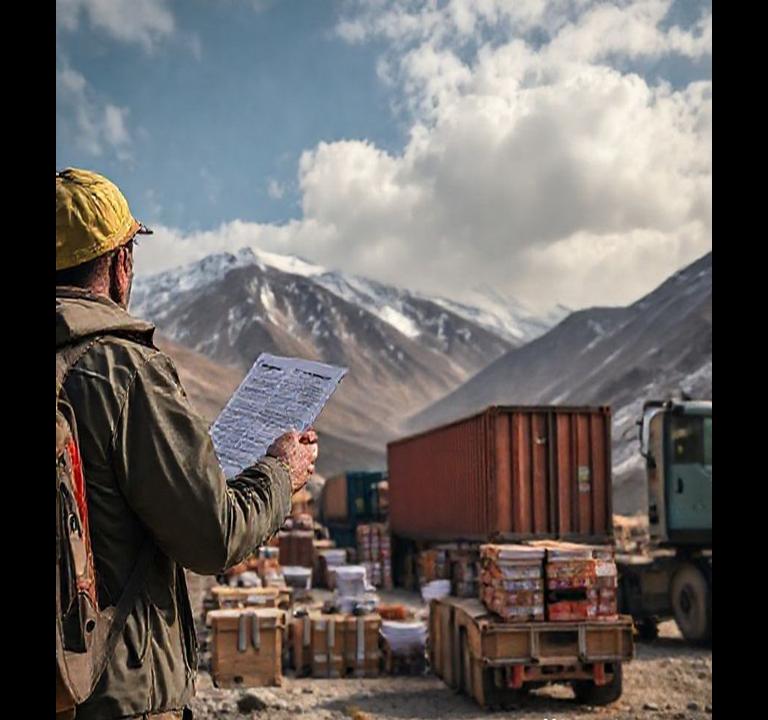

Discover how customs clearance can transform your logistics operations with the ultimate insider’s guide to demystifying Iraq’s complex customs clearance landscape through practical, actionable insights for international businesses. Customs clearance, the process of preparing and submitting documentation to ensure goods comply with local laws and regulations, is a critical component of international trade. For businesses operating in Iraq, understanding this process is essential to avoid delays, penalties, and operational disruptions.

This comprehensive guide explores customs clearance through multiple perspectives, providing valuable insights for logistics professionals and business owners alike. We’ll begin with “Understanding Customs Clearance in Iraq: A Comprehensive Overview,” where we’ll define key terms such as “duty,” a tax imposed on imported or exported goods, and “tariff,” a schedule of duties applied to specific products. Next, we’ll delve into “Key Documentation Requirements for Import and Export Customs Clearance,” including the “bill of lading,” a legal document issued by a carrier to acknowledge receipt of cargo for shipment.

Navigating Iraq’s customs regulations and duty structures can be daunting, but our guide simplifies this process in “Navigating Iraqi Customs Regulations and Duty Structures.” We’ll also provide a detailed “Step-by-Step Customs Clearance Procedures for Businesses,” ensuring you have a clear roadmap for compliance. Finally, we’ll discuss “Choosing the Right Customs Brokerage Services in Iraq,” highlighting the role of freight forwarding, the process of organizing shipments through carriers, in streamlining operations.

Why does this topic matter? Efficient customs clearance ensures timely delivery of goods, reduces costs, and enhances customer satisfaction. For businesses looking to expand their operations in Iraq, mastering this process is not just an advantage—it’s a necessity. By the end of this guide, you’ll have actionable insights to optimize your logistics operations and overcome the challenges of Iraq’s customs landscape. Let’s dive in and explore how you can leverage customs clearance to drive your business forward.

Understanding Customs Clearance in Iraq: A Comprehensive Overview

Understanding customs clearance in Iraq is essential for businesses engaged in international trade. This process involves adhering to specific regulations, submitting accurate documentation, and navigating potential challenges to ensure the smooth movement of goods across borders. Below, we explore the key aspects of customs clearance Iraq, including the regulatory framework, documentation requirements, and common challenges.

Key Regulatory Bodies and Legal Framework Governing Customs Procedures in Iraq

The customs clearance process in Iraq is primarily governed by the General Customs Authority (GCA), which oversees the enforcement of trade regulations and ensures compliance with national and international laws. The GCA operates under the Ministry of Finance and is responsible for implementing policies that facilitate trade while safeguarding national interests. Additionally, Iraq’s customs procedures are influenced by regional trade agreements and international standards. For instance, the government has recently imposed additional customs duties on certain imported goods to protect domestic industries. Understanding these regulations is crucial for businesses to avoid penalties and delays.

Documentation Requirements and Essential Paperwork for Successful Import/Export Clearance

Accurate documentation is the cornerstone of a successful customs clearance process. Importers and exporters in Iraq must provide a range of documents, including commercial invoices, bills of lading, certificates of origin, and packing lists. Additionally, specific goods may require additional permits or licenses, such as health certificates for food products or safety certifications for electronics. Working with experienced customs brokers in Iraq can help ensure that all paperwork is completed correctly and submitted on time. Failure to provide the necessary documents can result in delays, fines, or even the confiscation of goods.

Navigating Challenges and Potential Delays in Iraqi Customs Clearance Process

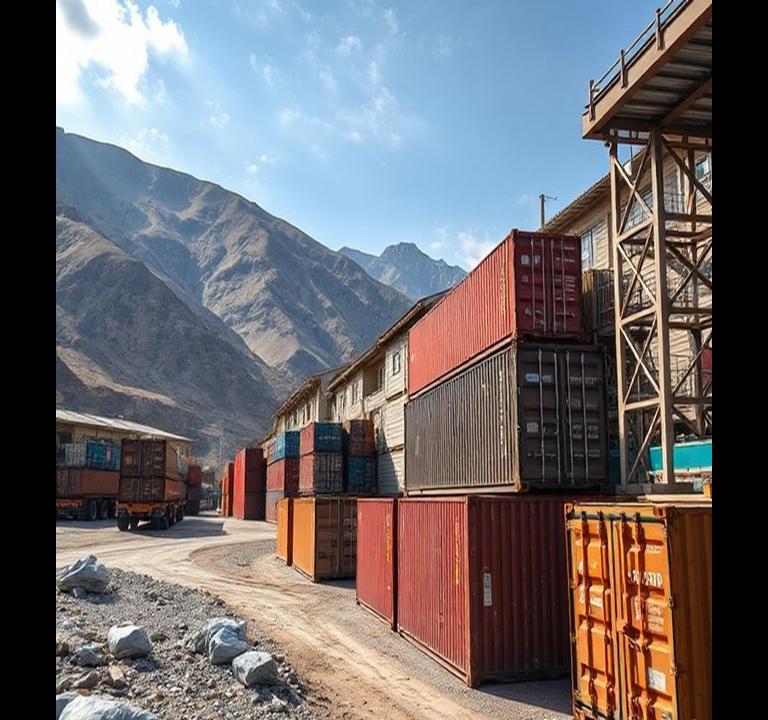

The customs clearance process in Iraq can be complex and time-consuming, often involving multiple inspections and bureaucratic hurdles. Common challenges include inconsistent enforcement of regulations, limited infrastructure at border crossings, and occasional political instability. For example, recent reports highlight how customs policies have led to increased costs for imported vehicles, causing public outcry. To mitigate these challenges, businesses should stay informed about regulatory changes, maintain clear communication with customs officials, and leverage the expertise of local logistics partners.

In conclusion, understanding the intricacies of customs clearance in Iraq is vital for businesses aiming to navigate the country’s trade landscape successfully. By familiarizing themselves with the regulatory framework, ensuring proper documentation, and addressing potential challenges, companies can streamline their operations and minimize disruptions.

Key Documentation Requirements for Import and Export Customs Clearance

Navigating the complexities of customs clearance requires a thorough understanding of the key documentation needed for both import and export transactions. Proper documentation ensures compliance with international trade regulations, minimizes delays, and facilitates smooth cross-border shipments. Below, we explore the essential paperwork and declarations required for efficient customs clearance Iraq.

Essential Commercial Documents Needed for Smooth International Trade Transactions

At the core of any international trade transaction are the commercial documents that validate the exchange of goods. The commercial invoice is a critical document, detailing the value, description, and quantity of the goods being shipped. It serves as the basis for customs valuation and duty calculation. Additionally, the packing list provides a detailed breakdown of the contents of each shipment, ensuring accuracy during customs inspections. For shipments involving transportation, a bill of lading or airway bill is required to confirm the transfer of goods from the seller to the buyer. These documents are indispensable for customs clearance in Iraq and other global markets.

Regulatory Compliance and Certification Paperwork for Cross-Border Shipments

Regulatory compliance is a cornerstone of customs clearance, requiring specific certifications and approvals depending on the nature of the goods. For instance, products like food, pharmaceuticals, and electronics often require certificates of origin to verify their production location and eligibility for trade agreements. Health and safety certifications, such as sanitary and phytosanitary certificates, may also be necessary for certain imports. In Iraq, compliance with customs duties regulations is essential to avoid penalties. Working with experienced customs brokers in Iraq can help ensure all regulatory requirements are met efficiently.

Accurate Valuation and Origin Declarations for Customs Processing

Accurate valuation and origin declarations are vital for customs processing, as they determine the applicable duties and taxes. The customs value of goods must reflect the total cost, including insurance and freight, as per the World Trade Organization’s valuation agreement. Misdeclaration can lead to delays, fines, or even seizure of goods. Similarly, the country of origin must be clearly stated to assess eligibility for preferential trade agreements or tariffs. For businesses engaging in import customs clearance in Iraq, ensuring precise documentation is critical to maintaining compliance and avoiding disruptions. Utilizing resources like freight market data can provide valuable insights into regional trade requirements.

In conclusion, mastering the documentation requirements for customs clearance is essential for successful international trade. From commercial invoices to regulatory certifications, each document plays a pivotal role in ensuring compliance and efficiency. By partnering with knowledgeable customs brokers and staying informed about regional regulations, businesses can streamline their cross-border operations and minimize risks.

Customs Clearance Navigating Iraqi Customs Regulations and Duty Structures

Navigating the intricacies of Iraqi customs regulations and duty structures is a critical aspect of successful international trade. Businesses engaged in customs clearance Iraq must understand the specific requirements to avoid delays, penalties, and other complications. This section provides a detailed exploration of key aspects, including import tariffs, documentation, and prohibited items.

Understanding Import Tariffs and Taxation Rates for Different Commodity Categories

Iraq employs a tariff system based on the Harmonized System (HS) codes, with varying taxation rates applied to different commodity categories. Understanding these rates is crucial for accurate cost calculation and financial planning. For instance, certain goods deemed essential may be subject to lower tariffs, while luxury items or goods produced locally may face higher rates. Recent reports indicate that the Iraqi government has, at times, imposed additional duties, such as those affecting customs duties changes on specific imported goods. Staying updated on these changes is paramount. Furthermore, a percentage is added to imports as taxes. These percentages depend on the type of imported goods and are subject to change according to the country’s economic needs.

Key Documentation Requirements and Compliance Procedures for Customs Clearance

Efficient customs clearance Iraq hinges on meticulous documentation and adherence to compliance procedures. Standard documentation includes the commercial invoice, packing list, bill of lading or airway bill, certificate of origin, and import license (if required). The accuracy and completeness of these documents are paramount. Any discrepancies can lead to delays, inspections, and potential fines. Furthermore, compliance with Iraqi standards and regulations is essential. This may involve obtaining certifications or approvals from relevant Iraqi authorities. Engaging experienced customs brokers Iraq can significantly streamline this process, ensuring all documentation is correctly prepared and submitted, and compliance requirements are met.

Navigating Restricted and Prohibited Items in Iraqi Import Regulations

Iraqi import regulations include a list of restricted and prohibited items. These restrictions may be based on security concerns, public health considerations, or the protection of local industries. Prohibited items may include certain weapons, drugs, and materials deemed harmful or offensive. Restricted items may require special permits or licenses for import. For example, changes in import regulations have led to soaring car prices due to increased customs. Businesses should conduct thorough due diligence to ensure their goods do not fall under these categories. Failure to comply with these regulations can result in the seizure of goods, penalties, and legal action. For example, the import of certain goods has led to increased prices and public outcry over prices.

Need Reliable Delivery Services?

Get a free quote from Direct Drive Logistic today. Fast, secure, and professional logistics solutions tailored to your needs.

Step-by-Step Customs Clearance Procedures for Businesses

Step-by-Step Customs Clearance Procedures for Businesses

Navigating the complexities of international trade requires a firm understanding of customs clearance procedures. For businesses expanding globally or managing international supply chains, mastering these steps is crucial to avoid delays, penalties, and ensure the smooth flow of goods. Here’s a detailed breakdown of the process:

Preparing Essential Documentation and Gathering Required Import/Export Paperwork

The first step in customs clearance is meticulously preparing and gathering all necessary documentation. This typically includes a commercial invoice, packing list, bill of lading or airway bill, certificate of origin, and any permits or licenses required based on the nature of the goods and the importing country’s regulations. For example, exporting certain chemicals might require specific export licenses, while importing agricultural products often necessitates phytosanitary certificates. Incomplete or inaccurate documentation is a common cause of delays, so double-checking all details is essential. Businesses should also be aware of specific requirements for countries like Iraq, where documentation standards may vary. Engaging with experienced customs brokers in Iraq can help navigate these specific requirements.

Navigating Tariff Classifications and Calculating Duties for International Shipments

Correctly classifying goods under the Harmonized System (HS) code is paramount for accurate duty calculation. The HS code determines the tariff rate applicable to the imported goods. Misclassification can lead to incorrect duty payments, potentially resulting in penalties or delays. Businesses should invest in training or consult with customs experts to ensure accurate classification. Calculating duties involves understanding the applicable tariff rate, any preferential trade agreements, and other taxes or fees levied by the importing country. For instance, a recent report on Iraq trade statistics highlights evolving tax laws that impact import costs. Staying updated on such changes is vital.

Completing Customs Declaration Forms and Managing Compliance Verification Process

Once the documentation is prepared and duties calculated, the next step involves completing the customs declaration form. This form provides customs authorities with detailed information about the shipment, including the goods’ description, value, origin, and intended use. Accuracy and completeness are crucial to avoid scrutiny and potential audits. After submitting the declaration, the shipment undergoes a compliance verification process, which may involve physical inspection of the goods, examination of documents, and verification of the declared value and classification. Businesses should be prepared to provide additional information or documentation as requested by customs authorities. Keeping abreast of the latest mandatory compliance is crucial for streamlined import processes. A recent instance of additional duties imposed on imported goods, such as the customs duties on intravenous solutions in Iraq, underscores the importance of staying informed on evolving regulations.

Choosing the Right Customs Brokerage Services in Iraq

Choosing the Right Customs Brokerage Services in Iraq

Navigating the intricacies of customs clearance Iraq requires a knowledgeable and reliable partner. Selecting the right customs brokerage service is crucial for ensuring smooth and efficient import and export operations. Several key factors should be considered when making this important decision.

Key Qualifications and Licensing Requirements for Iraqi Customs Brokers

In Iraq, customs brokers must meet specific qualifications and licensing requirements to operate legally. Ensure that any prospective customs brokers Iraq hold the necessary licenses from the relevant Iraqi authorities. Verify their credentials and check for any disciplinary actions or violations. A legitimate and qualified broker demonstrates a commitment to compliance and ethical practices. For instance, a broker should be well-versed in the latest amendments to Iraqi customs law and demonstrate a clear understanding of tariff classifications.

Evaluating Local Expertise and Understanding of Iraq’s Complex Customs Regulations

Iraq’s customs regulations can be complex and subject to change. Therefore, it’s essential to choose a brokerage with deep local expertise and a thorough understanding of these regulations. Look for a company with a proven track record of successful import customs clearance Iraq. Inquire about their experience with specific commodities and industries relevant to your business. A broker with strong relationships with local customs officials can often expedite the clearance process. For example, a customs broker experienced in handling shipments to Basra, a major port city, will be familiar with the specific procedures and challenges associated with that location.

Technology and Communication Capabilities for Efficient Customs Clearance Process

In today’s fast-paced business environment, technology plays a vital role in efficient customs clearance. Opt for a brokerage that utilizes advanced technology solutions for tracking shipments, managing documentation, and communicating with clients. Real-time visibility into the clearance process can help you anticipate potential delays and make informed decisions. Efficient communication is equally important. The brokerage should be responsive to your inquiries and provide regular updates on the status of your shipments. A good example of this is a brokerage that utilizes a web portal to allow clients to track their shipments and access important documents easily, offering transparency in global trade.

By carefully considering these factors, you can select a customs brokerage service that meets your specific needs and helps you navigate the complexities of customs clearance in Iraq effectively.

Frequently Asked Questions

▼ What is customs clearance, and why is it important for logistics in Iraq and Kurdistan?

Customs clearance is the process of verifying and approving goods entering or leaving a country. In Iraq and Kurdistan, it ensures compliance with local regulations, tariffs, and documentation. Efficient customs clearance is crucial for avoiding delays, reducing costs, and maintaining smooth logistics operations. Partnering with experts like Direct Drive Logistics ensures seamless navigation of Iraq’s complex customs procedures.

▼ How much does customs clearance cost in Iraq and Kurdistan?

Customs clearance costs in Iraq and Kurdistan vary based on factors like shipment type, value, and destination. Fees typically include duties, taxes, and service charges. For accurate estimates, consult with a logistics provider like Direct Drive Logistics, which offers transparent pricing and expertise in minimizing unexpected expenses.

▼ How long does customs clearance take in Iraq and Kurdistan?

Customs clearance in Iraq and Kurdistan can take 1-7 days, depending on shipment complexity, documentation accuracy, and customs workload. Delays often occur due to incomplete paperwork or inspections. Working with a trusted logistics partner ensures faster processing and minimizes downtime.

▼ What documents are required for customs clearance in Iraq and Kurdistan?

Required documents include a commercial invoice, packing list, bill of lading, certificate of origin, and import/export licenses. Specific goods may need additional permits. Ensuring accurate and complete documentation is critical for smooth customs clearance. Direct Drive Logistics provides end-to-end support to avoid errors.

▼ Why choose a logistics company for customs clearance in Iraq and Kurdistan?

Choosing a logistics company like Direct Drive Logistics ensures expertise in Iraq and Kurdistan’s customs regulations, faster processing, and reduced risk of delays. Their local knowledge and established relationships with customs authorities streamline the process, saving time and money for businesses.

▼ What are common challenges in customs clearance in Iraq and Kurdistan?

Common challenges include complex regulations, frequent policy changes, incomplete documentation, and inspections. Delays can disrupt supply chains and increase costs. Partnering with a logistics expert like Direct Drive Logistics helps navigate these challenges efficiently.

Conclusion

Navigating the complexities of customs clearance can be a daunting task, especially in a dynamic environment like Iraq. Throughout this article, we have explored the essential steps and requirements for ensuring smooth and efficient customs clearance, from understanding local regulations to preparing the necessary documentation. We’ve also highlighted the importance of staying updated with the latest trade policies and the benefits of leveraging technology to streamline the process.

At Direct Drive Logistics, we bring unparalleled expertise and a deep understanding of the Iraqi market to the table. Our team is dedicated to providing tailored solutions that not only meet but exceed your expectations, ensuring that your goods move seamlessly across borders. By partnering with us, you gain a reliable ally in the logistics journey, one that can help you navigate the intricacies of customs clearance with ease and efficiency.

Don’t let the challenges of customs clearance hold you back. Trust Direct Drive Logistics to deliver the expertise and support you need to succeed. Whether you’re a seasoned importer or just starting out, we are here to help. Contact us today to learn more about how we can assist you in optimizing your logistics operations and ensuring a hassle-free customs clearance experience.

Don’t let complex customs procedures slow down your international shipments – partner with Direct Drive Logistics for seamless, expert customs clearance that saves you time and reduces potential compliance risks. Streamline your global trade today by calling our dedicated customs specialists at (+964) 750 953 9899 and unlock faster, more efficient cross-border shipping solutions.

📞 Contact Us for a Consultation

Location

Direct Drive Logistic

MRF Quattro towers, Block A-29-1

Erbil, Kurdistan Region

Generated on November 10, 2025 at 07:41 AM