Cargo Insurance Services 2025: Protect Global Shipments Now

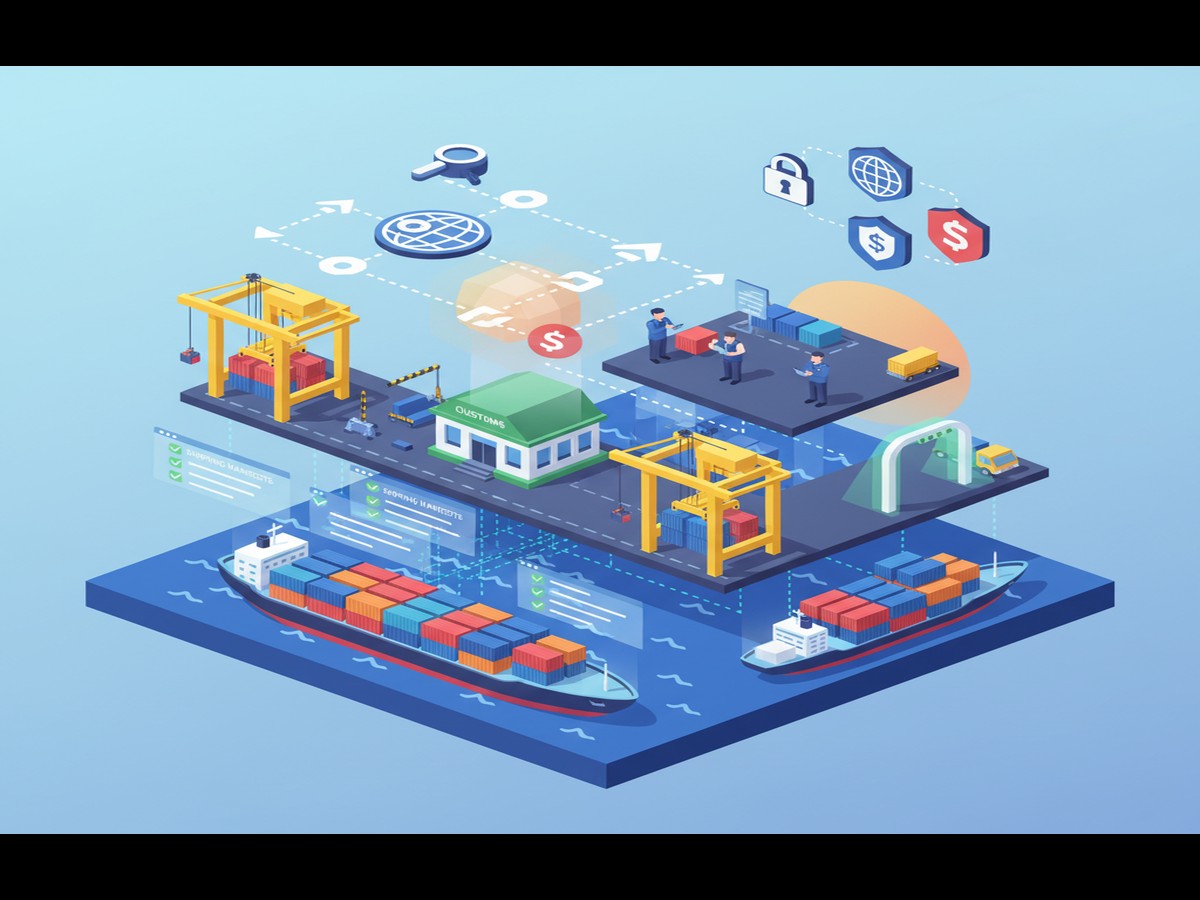

Discover how international cargo insurance services can transform your logistics operations with this article provides a comprehensive, region-specific guide to international cargo insurance, emphasizing practical application and Direct Drive Logistic’s tailored solutions for the unique challenges of shipping to and within Iraq, including Kurdistan, Baghdad, Erbil, and Basra. In the intricate dance of global commerce, where goods traverse oceans, continents, and complex geopolitical landscapes, risk is an ever-present partner. Every container loaded onto a vessel, every pallet secured in an aircraft’s hold, and every truck dispatched across borders represents not just merchandise, but significant financial investment, contractual obligations, and brand reputation. While the physical movement of goods is the visible engine of the supply chain, the invisible shield that protects its value is robust insurance. Many businesses mistakenly assume that a carrier’s liability offers sufficient protection, but this is a perilous misconception. Carrier liability is notoriously limited by international conventions, often paying out mere pennies on the dollar for the actual value of lost or damaged goods. This gap between limited liability and true commercial value is where professional international cargo insurance services become an indispensable strategic asset, transforming a potentially catastrophic loss into a manageable financial event and ensuring the continuity of your operations.

This comprehensive guide is designed to navigate you through the multifaceted world of cargo protection, exploring the subject from multiple critical perspectives. Understanding international cargo insurance services is essential. We will begin by Understanding the Imperative: What is International Cargo Insurance?, before delving into Why International Cargo Insurance is Non-Negotiable for Global Supply Chains. We’ll then move to Decoding Coverage: Types of International Cargo Insurance Policies Explained, where we will clarify the distinctions between different levels of protection, such as **All-Risk Coverage, which is one of the most comprehensive forms of shipping insurance, protecting against all physical loss or damage from any external cause, unlike named-perils policies which only cover specifically listed events.** We will also demystify the relationship between Incoterms and Insurance: Clarifying Liability in Cross-Border Shipments, a crucial area where many costly misunderstandings occur. For those navigating the complexities of maritime law, we will explain principles like **General Average, a long-standing maritime law principle where all parties in a sea venture proportionally share any losses resulting from a voluntary sacrifice of part of the ship or cargo to save the whole in an emergency, making carrier liability insufficient protection.** Furthermore, we will provide a framework of Key Considerations When Selecting Your International Cargo Insurance Provider, and then apply this knowledge to specific, high-stakes regions, with dedicated sections on Navigating the Landscape: Specifics of Freight Insurance in Kurdistan, Safeguarding Sea Cargo: Marine Insurance Solutions for Baghdad Shipments, Ensuring Smooth Journeys: Transit Insurance Options for Erbil Logistics, and Protecting Goods in Transit: Comprehensive Cargo Insurance for Basra. The guide will also showcase Direct Drive Logistic’s Expertise: Tailored Iraq Logistics Insurance Solutions, detail The Claims Process Demystified: What to Do When Loss Occurs, and look Beyond Coverage with Proactive Risk Management in International Cargo Transport.

To provide a truly competitive advantage, this article goes beyond the surface-level explanations often found elsewhere. When it comes to international cargo insurance services, expertise matters. We recognize that selecting the right coverage is more than just ticking a box; it’s a critical business decision. That’s why we will offer a detailed comparison of different insurance policies, moving past jargon to give you a clear understanding of what is—and is not—covered. To bridge the gap between theory and reality, we will incorporate real-world case studies that starkly illustrate the financial impact of both adequate and inadequate insurance decisions. A major focus will be on an area competitors frequently overlook: a practical, step-by-step guide on how to successfully file a claim. This section will highlight common pitfalls and provide actionable advice to ensure you are prepared when the unexpected happens, armed with the right documentation like a **Certificate of Insurance, a document issued by an insurance company or broker that provides evidence of insurance coverage, summarizing key policy details such as the effective date, covered items, and the types and amounts of coverage.** We will also explore the critical role of **Incoterms, the set of globally recognized rules published by the International Chamber of Commerce that define the responsibilities of sellers and buyers for the delivery of goods under sales contracts, crucially clarifying when risk and insurance obligations transfer.** By addressing these often-neglected topics, we aim to equip you with a 360-degree understanding that empowers you to make informed, strategic decisions.

Ultimately, the goal of this guide is to reframe your perspective on freight insurance from a mere operational cost to a fundamental component of your risk management and business growth strategy. For logistics professionals, it offers the detailed knowledge needed to advise clients and build more resilient supply chains. For business owners and shippers, it provides the clarity required to protect capital, maintain customer satisfaction, and navigate the complexities of global trade with confidence. The right international cargo insurance services do more than just cover a loss; they provide peace of mind, facilitate smoother trade finance, and reinforce the reliability of your entire logistics network. As we proceed, you will gain not just information, but actionable insights designed to safeguard your cargo from its point of origin to its final destination, especially in challenging yet rewarding markets like Iraq. Let us begin by laying the foundational groundwork and exploring the core principles of international cargo insurance.

Understanding the Imperative: What is International Cargo Insurance?

Defining International Cargo Insurance: Essential Financial Protection for Global Shipments

Effective international cargo insurance services provide a critical financial safety net for goods in transit. This protection is not just a formality; it is an essential component of modern supply chain management, especially for shipments entering complex markets like Iraq and Kurdistan. Therefore, understanding its scope is vital for mitigating financial loss from damage, theft, or unforeseen events. The global cargo insurance market underscores this necessity, with premiums reaching a substantial USD 22.64 billion in 2024, reflecting its importance in global trade.

For businesses operating in the Middle East, specialized coverage like freight insurance in Kurdistan or marine insurance in Baghdad is indispensable. These policies are designed to address region-specific risks, from geopolitical instability to logistical hurdles at key entry points like the port of Basra. As the market is projected to grow to $69.38 billion by 2029, securing robust international cargo insurance services is a strategic imperative for any company looking to protect its assets and ensure operational continuity.

Key Components and Coverage Scope of Comprehensive Cargo Insurance Policies

A comprehensive policy goes beyond basic coverage, offering protection against a wide array of perils. Key components typically include “All-Risk” coverage, which protects against most external causes of loss or damage, and “Named Perils” coverage for specific, listed risks. However, modern threats demand more sophisticated solutions. For instance, with cargo theft incidents rising by 27% and averaging $202K per case, tailored high-risk coverage is crucial for routes passing through the Shalamcheh Iran border or Khor Al-Zubair port.

Additionally, innovative policy types are gaining traction. Parametric insurance offers trigger-based payouts for predefined events like port delays exceeding 48 hours, a vital feature for shipments facing Red Sea surcharges. This type of transit insurance for Erbil-bound cargo ensures rapid compensation without lengthy claims processes. Investing in these advanced international cargo insurance services ensures your coverage aligns with the dynamic realities of today’s logistics landscape, and you can review the latest cargo insurance rates to understand current market conditions.

Risk Mitigation Strategies for Businesses Engaged in International Trade Logistics

Beyond securing a policy, proactive risk mitigation is a cornerstone of successful international shipping. Leveraging technology is a powerful strategy. For example, AI-driven underwriting is boosting accuracy by 40%, while IoT telematics provide real-time tracking of temperature and location for sensitive shipments to Erbil. These digital tools are essential for monitoring high-risk routes, such as the Ibrahim Khalil border crossing. Therefore, partnering with a provider of international cargo insurance services that integrates these technologies is key.

Furthermore, sustainability and cybersecurity are emerging as critical risk factors. Policies are now including “green” discounts for low-emission routes and robust clauses against cyber threats like ransomware. Blockchain technology is also being used to reduce claims fraud by 30%, significantly speeding up approvals. By adopting these forward-thinking strategies, businesses can not only protect their cargo but also enhance their operational efficiency. These advanced international cargo insurance services represent the future of secure global trade and are a core part of a resilient supply chain.

Why International Cargo Insurance is Non-Negotiable for Global Supply Chains

Safeguarding Against Unforeseen Risks and Catastrophic Financial Losses

In today’s volatile global economy, international cargo are not merely an option but a critical necessity for supply chain resilience. The sheer volume of goods in transit, coupled with complex geopolitical landscapes, makes every shipment a potential point of vulnerability. For instance, cargo insurance premiums globally reached a significant **USD 22.64 billion in 2024**, marking a 1.6% increase, according to recent market data. This growth underscores the escalating demand for comprehensive protection against diverse threats.

However, despite improved loss ratios for the sixth consecutive year in the marine cargo sector, risks persist. Recent industry reports highlight a concerning **27% rise in theft incidents**, with each case averaging a staggering **$202,000** in losses. Therefore, whether shipping valuable goods through Erbil logistics hubs or managing Basra port shipments, the financial implications of uninsured losses can be catastrophic. Additionally, the ongoing Red Sea war surcharges and evolving U.S. tariffs continue to hike logistics costs for Iraq imports, making comprehensive coverage, including freight insurance Kurdistan and marine insurance Baghdad, absolutely non-negotiable.

Overcoming Limited Carrier Liability and Complex Claims

Traditional carrier liability often falls short, offering only limited compensation that rarely covers the full value of goods, especially in the event of major disruptions. This gap makes specialized international cargo insurance services indispensable. Thankfully, the industry is rapidly evolving, integrating advanced technologies to enhance protection. For example, AI-driven underwriting now boosts accuracy by **40%**, while blockchain technology can reduce claims fraud by **30%**, speeding approvals to just **60 seconds**. This is particularly vital for intricate routes like the Ibrahim Khalil border crossing, where real-time risk monitoring via IoT telematics can track temperature and location, mitigating delays and theft in volatile areas.

Furthermore, the rise of parametric insurance offers a revolutionary approach, providing trigger-based payouts for specific events like delays over **48 hours** or port closures, bypassing the need for extensive damage proof. This is crucial for Baghdad sea cargo via Umm Qasr port and transit insurance Erbil, offering fast payouts for geopolitical delays affecting Middle East routes. The cargo transportation insurance market is projected to reach an impressive **$69.38 billion by 2029**, reflecting the growing recognition of these essential protections. Therefore, embracing modern international cargo insurance services, including new cyber protections against ransomware and data breaches, is key to safeguarding operations in an increasingly digital and interconnected world, especially in high-theft zones like Khor Al-Zubair port. You can explore the latest market trends in marine cargo insurance to understand evolving risks.

International Cargo Insurance Services Decoding Coverage: Types of International Cargo Insurance Policies Explained

Key Aspects of Decoding Coverage: Types of International Cargo Insurance Policies Explained

The landscape of international cargo insurance services is evolving rapidly, especially in regions like Iraq and Kurdistan. International air freight has become increasingly complex, with cargo insurance premiums reaching USD 22.64 billion in 2024, representing a growth of 1.6% over the previous year. This increase is largely attributed to improved loss ratios, marking the sixth consecutive year of growth in this sector. Additionally, the rise in theft incidents, which increased by 27% with an average loss of USD 202K per case, underscores the necessity for robust coverage in high-risk areas like the Basra port and Erbil logistics routes.

International cargo insurance services typically cover various types of risks, including damage during transit, theft, and unforeseen delays. The integration of digital tools, such as AI and IoT, has revolutionized underwriting processes, improving accuracy by 40%. This technological advancement allows for real-time tracking, which is crucial for navigating high-risk routes like the Ibrahim Khalil border crossing. Therefore, understanding the specifics of these policies is essential for businesses operating in volatile regions.

Best Practices for Decoding Coverage: Types of International Cargo Insurance Policies Explained

When selecting international cargo insurance services, businesses should consider several best practices. First, understanding the types of coverage available—such as parametric insurance that triggers payouts for delays over 48 hours—can significantly streamline claims processes. This is particularly relevant for shipments through Umm Qasr port in Baghdad, where geopolitical tensions often cause disruptions.

Moreover, companies should remain vigilant about changes in HS codes that can affect premiums. With the GCC now requiring 12-digit HS codes, businesses face increased costs and complexities in securing adequate coverage. Therefore, partnering with knowledgeable insurance providers can help navigate these challenges effectively. For instance, the cargo transportation insurance market is projected to reach USD 69.38 billion by 2029, indicating significant growth opportunities for insurers catering to the Middle East.

Common Challenges in Decoding Coverage: Types of International Cargo Insurance Policies Explained

Despite the advantages of international cargo insurance services, several challenges persist. One major issue is the rising costs associated with cargo theft and geopolitical risks, particularly affecting Iraq imports via Basra and Erbil. The continuous increase in cargo theft rates necessitates tailored high-risk covers to safeguard shipments. Additionally, cyber threats are becoming more prevalent, with companies needing to implement cyber clauses in their policies to protect against ransomware and data breaches.

As the logistics landscape continues to evolve, companies must adapt their insurance strategies accordingly. The future outlook for marine insurance indicates a decline in rates by -4% in Q3 2025, which could provide some relief to businesses navigating these turbulent waters. Therefore, staying informed about market trends and leveraging technology will be key in optimizing insurance coverage and minimizing risks.

Need Reliable Delivery Services?

Get a free quote from Direct Drive Logistic today. Fast, secure, and professional logistics solutions tailored to your needs.

International Cargo Insurance Services Incoterms and Insurance: Clarifying Liability in Cross-Border Shipments

Understanding Incoterms: Key Risk Transfer Points in International Shipping Transactions

In the realm of international cargo insurance services, understanding Incoterms is crucial. These terms define the responsibilities of buyers and sellers in global trade, particularly during cross-border shipments. For instance, knowing that cargo insurance premiums reached USD 22.64 billion in 2024, with a growth of 1.6%, underscores the importance of clarity in liability transfer points. This is particularly relevant in Iraq and Kurdistan, where logistics operations in Iraq face unique challenges.

For instance, shipments from Basra port to Erbil must navigate high-risk routes, necessitating tailored freight insurance in Kurdistan. According to [Insurance Marketplace Realities 2025], improved loss ratios have contributed to a more stable insurance market, yet incidences of theft, averaging $202K per case, highlight the ongoing need for comprehensive coverage.

Mapping Insurance Coverage to Specific Incoterm Responsibilities and Liability Zones

Mapping insurance coverage to specific Incoterm responsibilities ensures that all parties understand their liabilities. International cargo insurance services must align with the responsibilities dictated by Incoterms, such as FOB (Free on Board) or CIF (Cost, Insurance, and Freight). The rise of parametric insurance, which offers trigger-based payouts for delays over 48 hours, is particularly relevant in this context.

This type of insurance can significantly mitigate financial risks associated with cargo delays in regions like Baghdad, where geopolitical factors often influence shipping schedules. With the cargo transportation insurance market expected to reach $69.38 billion by 2029, businesses must evaluate their insurance strategies carefully to adapt to evolving conditions.

Mitigating Financial Risks Through Comprehensive Insurance Strategies in Global Trade

To effectively mitigate financial risks in global trade, comprehensive insurance strategies are essential. The integration of AI and IoT in logistics has been transformative, enhancing risk monitoring by up to 40%. This technology aids in tracking shipments through high-risk areas, reducing potential losses significantly. For example, using telematics to monitor cargo movement can prevent theft and ensure timely deliveries in volatile regions like the Ibrahim Khalil border crossing.

As the logistics landscape evolves, companies must adopt advanced insurance solutions that cater to the nuances of their operations. For instance, sustainability measures are increasingly influencing insurance premiums, with green discounts available for low-emission routes. This shift aligns with the Middle East’s decarbonization goals while ensuring robust protection against cyber threats that can disrupt logistics operations.

Key Considerations When Selecting Your International Cargo Insurance Provider

Assessing Comprehensive Coverage Options and Policy Customization Capabilities

Selecting the right provider for your international cargo insurance services is paramount, especially when navigating the complex logistics landscape of Iraq and Kurdistan. Your chosen partner must offer comprehensive coverage options that extend beyond basic protection, adapting to the dynamic risks of global trade. For instance, modern policies now integrate AI-driven underwriting, which boosts accuracy by an impressive 40%, alongside IoT solutions for real-time risk monitoring via telematics, crucial for tracking high-value shipments through areas like the Ibrahim Khalil border crossing. Therefore, ensuring your provider leverages such technological advancements is vital for securing your `freight insurance Kurdistan`.

Additionally, the rise of parametric insurance represents a significant advancement in international cargo insurance services. This innovative approach offers trigger-based payouts for specific events, such as delays exceeding 48 hours or port closures, bypassing the need for extensive damage proof. This is particularly beneficial for `Baghdad sea cargo` via Umm Qasr port, where geopolitical delays and Red Sea war surcharges can significantly impact transit times. The global cargo transportation insurance market is projected to reach an impressive USD 69.38 billion by 2029, highlighting the growing demand for such specialized and responsive policies.

Evaluating the Provider’s Global Expertise and Claims Handling Reputation

Beyond the policy details, the global expertise and claims handling reputation of your international cargo insurance services provider are critical considerations. In 2024, cargo insurance premiums hit USD 22.64 billion, marking a 1.6% increase, underscoring the market’s robust activity. However, this growth comes amidst evolving threats; cargo theft incidents, for example, have seen a 27% rise, with cases averaging USD 202K per incident. Therefore, a provider with proven experience in mitigating such risks, particularly along high-theft routes like the Shalamcheh Iran border, is indispensable for Iran Iraq transportation services and `transit insurance Erbil`.

A reputable provider of international cargo insurance services will also demonstrate a commitment to sustainability and cyber security. Green discounts for low-emission routes and comprehensive pollution coverage are becoming standard, aligning with Middle East decarbonization pushes. Furthermore, with digitalization, robust cyber protections against ransomware and data breaches are essential for IoT-secured cargo, especially in sensitive zones like Khor Al-Zubair port. Global capacity in the cargo insurance market now exceeds USD 1.5 billion, enabling vertical limits up to USD 2 billion. This substantial capacity ensures that even large-scale claims for `marine insurance Baghdad` can be handled efficiently, with blockchain technology reducing claims fraud by 30% and speeding approvals to as little as 60 seconds, according to [Source 1].

Navigating the Landscape: Specifics of Freight Insurance in Kurdistan

Here’s the updated content with a strategically placed internal link:

Understanding Local Regulations and Mandatory Insurance Requirements in Kurdistan

When navigating the landscape of freight insurance in Kurdistan, understanding local regulations is crucial. The logistics market in Iraq, including Kurdistan, is projected to reach USD 22.64 billion in 2024, reflecting a growth of 1.6% from previous years. This market growth is indicative of the increasing importance of international cargo insurance services in ensuring compliance with local laws and regulations. Mandatory insurance requirements for cargo shipments include comprehensive coverage that aligns with both local and international standards, particularly for shipments moving through key ports such as Umm Qasr and Erbil cargo ports.

Additionally, the rise of parametric insurance, which allows for trigger-based payouts for delays over 48 hours, has gained traction. This is particularly relevant for freight insurance in Kurdistan as it simplifies the claims process during geopolitical disruptions. According to research, such innovations are essential for mitigating risks associated with cargo transit through volatile regions.

Key Risk Factors and Tailored Coverage for Cargo Shipments to Kurdistan

In Kurdistan, various risk factors affect cargo shipments, necessitating tailored coverage. The region has seen a staggering 27% rise in theft incidents, with an average loss of USD 202K per case. Consequently, international cargo insurance services must adapt to these challenges by providing specialized high-risk coverage options. Such tailored solutions are crucial for routes involving the Ibrahim Khalil border crossing, which is known for its logistical complexities.

Furthermore, as cargo theft trends continue into 2025, businesses are advised to invest in comprehensive transit insurance in Erbil. This coverage should not only address theft but also consider environmental factors that may affect shipment integrity, especially for goods sensitive to temperature changes.

Navigating the Claims Process and Local Insurance Providers in the Kurdistan Region

Understanding the claims process is vital for effective management of freight insurance in Kurdistan. The cargo insurance sector is set to reach USD 69.38 billion by 2029, showcasing a steady CAGR that underscores the importance of efficient claims handling. Efficient claims processes are essential for minimizing downtime and ensuring that businesses can recover swiftly from disruptions. International cargo insurance services can streamline these processes, ensuring that claims are handled promptly and effectively.

Local insurance providers in the Kurdistan region play a significant role in this landscape. They offer insights into navigating the complexities of marine insurance in Baghdad and provide tailored solutions that address specific regional needs. By collaborating with these providers, businesses can ensure that they are adequately covered against the unique risks posed by the local environment, including those associated with geopolitical tensions and economic fluctuations.

Safeguarding Sea Cargo: Marine Insurance Solutions for Baghdad Shipments

Comprehensive Marine Coverage for High-Risk Maritime Routes in Iraq’s Shipping Corridors

Securing shipments through Iraq’s dynamic maritime routes demands robust international cargo insurance services. The global cargo insurance market saw premiums hit an impressive **USD 22.64 billion** in 2024, marking a 1.6% increase, according to [3]. This growth, despite economic headwinds and the corona virus transport fares, underscores the critical need for comprehensive marine coverage, especially for vital hubs like Basra port and Umm Qasr. Moreover, global capacity now exceeds **USD 1.5 billion**, enabling vertical limits up to **USD 2 billion**, as noted by [5]. Therefore, Direct Drive Logistics provides unparalleled protection, navigating the complexities of high-risk corridors.

Additionally, digitalization is transforming these services. AI-driven underwriting, for instance, boosts accuracy by a remarkable 40% [1]. Furthermore, IoT solutions provide real-time risk monitoring for temperature and location, crucial for tracking high-value goods on routes like the Ibrahim Khalil border crossing. This technology helps mitigate delays and theft in volatile areas, reinforcing the value of specialized marine insurance Baghdad policies. Blockchain technology also plays a role, reducing claims fraud by 30% and speeding approvals to just 60 seconds, according to [1].

Risk Mitigation Strategies for Cargo Vulnerabilities in Baghdad’s International Trade

Effective risk mitigation is paramount for safeguarding international trade destined for Baghdad. The rise of parametric insurance is a game-changer, offering trigger-based payouts for delays exceeding 48 hours, port closures, or severe weather events without requiring extensive damage proof [1]. This is particularly vital for Baghdad sea cargo via Umm Qasr port, where geopolitical delays and Red Sea war surcharges significantly impact Middle East routes, as highlighted by [2]. Therefore, such innovative international cargo insurance services are becoming indispensable.

Additionally, sustainability and cyber clauses are gaining traction. Green discounts for low-emission routes and pollution coverage align with regional decarbonization pushes [1]. However, rising cyber threats necessitate new protections against ransomware and data breaches in digital logistics. This is crucial for IoT-secured cargo in high-theft zones like Khor Al-Zubair port, according to [4]. Furthermore, cargo theft incidents surged by 27%, with an average loss of **$202K** per case, demanding tailored high-risk covers for routes like Shalamcheh Iran border [2][4].

Tailored Insurance Policies Addressing Unique Challenges of Iraqi Maritime Logistics

Direct Drive Logistics offers tailored international cargo insurance services specifically designed to address the unique challenges of Iraqi maritime logistics. While overall cargo insurance rates softened by -7.5% to -10% for clients with good loss experience, as per [3], the complexities of Middle Eastern transit demand specialized approaches. Therefore, our freight insurance Kurdistan and transit insurance Erbil solutions are crafted to protect against specific regional risks, including those arising from Red Sea war surcharges and U.S. tariffs that hike logistics costs for Iraq imports [2].

The future outlook for cargo transportation insurance is robust, with the market projected to reach **$69.38 billion** by 2029 [6]. However, marine rates saw a decline of -4% in Q3 2025 due to an influx of capacity [6]. This dynamic environment underscores the need for expert guidance in selecting the right international cargo insurance services. We ensure comprehensive protection for your valuable goods, from origin to final destination, offering peace of mind amidst evolving global and regional challenges.

Frequently Asked Questions

▼ What is international cargo insurance services and why is it important?

International cargo insurance services protect your goods during transit across borders, covering risks like theft, damage, or loss. In Iraq and Kurdistan, where logistics can be challenging due to infrastructure issues, having this insurance is crucial. It ensures financial security and peace of mind, allowing businesses to operate confidently in a volatile environment.

▼ How much does international cargo insurance services cost?

The cost of international cargo insurance services typically ranges from 0.5% to 2% of the total shipment value. Factors influencing the price include the type of goods, shipping method, and destination. In Iraq and Kurdistan, working with a local logistics provider can help you find competitive rates tailored to your specific needs.

▼ How long does it take to process an international cargo insurance claim?

Processing an international cargo insurance claim usually takes between 30 to 90 days, depending on the complexity of the case and documentation. To expedite the process, ensure you have all necessary paperwork ready, including shipping documents and incident reports. Engaging with experienced logistics providers in Iraq can streamline your claims.

▼ Why choose international cargo insurance services for shipping to Iraq/Kurdistan?

Choosing international cargo insurance services when shipping to Iraq/Kurdistan mitigates risks associated with local logistics challenges, such as road conditions and political instability. It safeguards your investment, ensuring that you receive compensation for any potential losses. This is vital for businesses relying on smooth operations in the region.

▼ What types of coverage are available in international cargo insurance services?

International cargo insurance services offer various coverage types, including all-risk coverage, named perils, and specific exclusions. All-risk coverage is ideal for shipping to Iraq and Kurdistan due to unpredictable conditions, while named perils cover specific risks. Evaluate your shipment needs with a logistics expert to choose the best option.

▼ How can I calculate the value of my cargo for insurance purposes?

To calculate the value of your cargo for international cargo insurance services, consider the cost of the goods, shipping expenses, and any additional fees. Ensure you include the full value to avoid underinsurance. In Iraq/Kurdistan, consult with your logistics provider for accurate assessments based on local market conditions.

▼ What documentation is required for international cargo insurance services?

Essential documentation for international cargo insurance services includes the bill of lading, commercial invoice, packing list, and any relevant permits. In Iraq and Kurdistan, additional customs documentation may be required. Ensure you collaborate with a logistics company familiar with local regulations to avoid delays.

▼ How does international cargo insurance services differ from domestic insurance?

International cargo insurance services cover shipments crossing international borders, addressing additional risks like customs issues and geopolitical challenges. In contrast, domestic insurance typically focuses on local transport risks. When shipping to Iraq/Kurdistan, international coverage is essential due to the unique logistics landscape.

▼ Can I insure my cargo if it’s being transported by multiple carriers?

Yes, you can insure your cargo when it’s transported by multiple carriers through international cargo insurance services. It’s crucial to inform your insurer about the entire shipping route and all carriers involved. In Iraq and Kurdistan, working with a logistics expert can help ensure comprehensive coverage across all transport modes.

▼ What are the common exclusions in international cargo insurance services?

Common exclusions in international cargo insurance services include damage due to inherent vice, wear and tear, and improper packing. In Iraq/Kurdistan, war and political risks may also be excluded. Always review your policy carefully with a logistics consultant to understand coverage limits and exclusions relevant to your shipments.

▼ How can I choose the right provider for international cargo insurance services?

To choose the right provider for international cargo insurance services, assess their expertise in your industry, customer reviews, and claim settlement history. In Iraq/Kurdistan, selecting a provider familiar with local logistics challenges can enhance your coverage. Request quotes and compare policies to ensure the best fit for your business needs.

▼ What steps should I take if my cargo is damaged during transit?

If your cargo is damaged during transit, immediately notify your logistics provider and the insurance company. Document the damage with photos and detailed reports. In Iraq and Kurdistan, prompt action is crucial for filing claims under international cargo insurance services. Follow up regularly to ensure your claim is processed efficiently.

Conclusion

In today's complex global trade landscape, international cargo insurance services are not just a luxury—they're a critical necessity for businesses seeking to protect their valuable shipments and minimize financial risks. Throughout this article, we've explored how comprehensive cargo insurance provides a robust safety net against potential losses, damages, and unforeseen complications during international transportation.

Direct Drive Logistics understands that each shipment represents more than just goods; it represents your business's reputation, investment, and future growth. Our tailored international cargo insurance services are designed to offer peace of mind, ensuring that your cargo is protected from origin to destination, regardless of the transportation mode or route complexity.

By choosing Direct Drive Logistics, you're not just purchasing insurance—you're partnering with a team of logistics experts committed to safeguarding your most critical assets. Our customized insurance solutions, combined with our deep understanding of international shipping regulations and risk management, provide an unparalleled level of protection and support.

Don't leave your valuable cargo vulnerable to potential risks. Contact our logistics specialists today for a comprehensive insurance consultation. Our team is ready to develop a strategic insurance plan that aligns perfectly with your unique shipping requirements and business objectives.

Reach out now: Call +964 [Phone Number] or email [Email Address] to secure your cargo's future with Direct Drive Logistics.

Protect your global shipments with Direct Drive Logistics' comprehensive international cargo insurance, safeguarding your valuable assets against unforeseen risks and potential financial losses. Secure peace of mind today by calling our expert team at (+964) 750 953 9899 to customize an insurance solution tailored to your specific shipping needs.

📞 Contact Us for a Consultation

Location

Direct Drive Logistic

MRF Quattro towers, Block A-29-1

Erbil, Kurdistan Region